Williams (WMB) Q2 Earnings Top Estimates, Revenues Miss

The Williams Companies, Inc. WMB reported second-quarter 2020 adjusted earnings per share of 25 cents, beating the Zacks Consensus Estimate of 23 cents, attributable to a strong contribution from the Northeast G&P unit. However, the bottom line marginally missed the year-earlier quarter's adjusted earnings of 26 cents due to weak contribution from the Transmission & Gulf of Mexico and West segments.

The energy infrastructure provider’s quarterly revenues of $1.78 billion also lagged the Zacks Consensus Estimate by 4.23% and decreased from the year-ago figure of $2.04 billion as well.

Distributable cash flows came in at $797 million, down 8.07% from the year-ago number of $867 million. Adjusted EBITDA was $1.24 billion in the quarter under review, in line with the year-ago quarter’s figure. Cash flow from operations totaled $1.14 billion compared with $1.07 billion in the prior-year period. Lower maintenance capital drove cash flow in the quarter.

Segmental Analysis

Transmission & Gulf of Mexico: Consisting of Williams’ Transco Pipeline and assets in the Gulf Coast area, the segment generated adjusted EBITDA of $617 million, down 1.75% from $628 million in the year-ago quarter. This underperformance was caused by depressed service revenues from lower deferred revenue amortization at Gulfstar One. Apart from declining revenues, a number of temporary production shut-ins across the Gulf of Mexico induced by oil prices, maintenance and Tropical Storm Cristobal hampered segment profitability.

West: This segment includes the Northwest pipeline and operations in various regions, such as Colorado, Mid-Continent and Haynesville Shale among others. It delivered adjusted EBITDA of $252 million, 12.2% lower than the year-earlier figure of $287 million. Soft revenues in Barnett Shale affected the results.

Northeast G&P: Engaged in natural gas gathering and processing along with the NGL fractionation business in Marcellus and Utica shale regions, the segment generated adjusted EBITDA of $363 million, up 13.8% from the prior-year quarter’s $319 million. Expanded volumes from the new Northeast JV along with added ownership in Utica East Ohio Midstream boosted results. Moreover, cost-minimizing efforts aided segmental profitability.

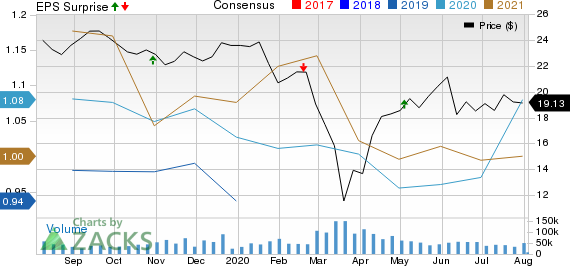

Williams Companies, Inc. The Price, Consensus and EPS Surprise

Williams Companies, Inc. The price-consensus-eps-surprise-chart | Williams Companies, Inc. The Quote

Costs, Capex & Balance Sheet

In the reported quarter, total costs and expenses decreased to $1.17 billion from $1.54 billion a year ago owing to fall in product expenses and G&A costs.

Williams’ total capital expenditure was $613 million in the second quarter, down substantially from $919 million a year ago. As of Jun 30, 2020, the company had cash and cash equivalents worth $1.13 billion and a long-term debt of $22.3 billion with a debt-to-capitalization of 64.6%.

2020 Guidance

The company anticipates full-year adjusted EBITDA in the lower end of its earlier guided range of $4.95-$5.25 billion. Growth capex view for the year is now expected in the $1-$1.2 billion band, lower than the earlier-issued $1.1-$1.3 billion range.

Zacks Rank & Key Picks

Williams currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the energy space are Halliburton Company HAL, Core Laboratories NV CLB and Pembina Pipeline Corp PBA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

Williams Companies, Inc. The (WMB) : Free Stock Analysis Report

Core Laboratories N.V. (CLB) : Free Stock Analysis Report

Pembina Pipeline Corp. (PBA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research