Some Wine's Link International Holdings (HKG:8509) Shareholders Are Down 19%

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Wine's Link International Holdings Limited (HKG:8509) share price slid 19% over twelve months. That contrasts poorly with the market return of -9.0%. Wine's Link International Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 12% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 8.6% in the same period.

See our latest analysis for Wine's Link International Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Wine's Link International Holdings share price fell, it actually saw its earnings per share (EPS) improve by 15%. It's quite possible that growth expectations may have been unreasonable in the past. It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

Wine's Link International Holdings managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

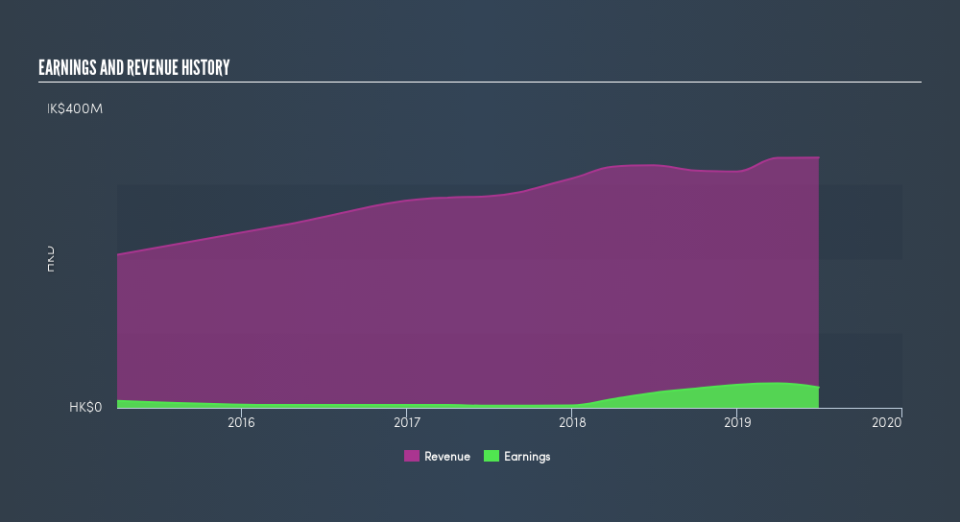

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Wine's Link International Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt Wine's Link International Holdings shareholders are happy with the loss of 19% over twelve months. That falls short of the market, which lost 9.0%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 12% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Is Wine's Link International Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

Of course Wine's Link International Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.