WML.V: Wealth Minerals Advances Multiple Projects: Review of Last 12 Months

TSX:WML.V | OTC:WMLLF

READ THE FULL WML.V RESEARCH REPORT

Wealth Minerals (TSX:WML.V) (OTC:WMLLF) is a junior mineral exploration company that is well-positioned to benefit from its portfolio of prospective lithium projects in the Lithium Triangle. The company holds control over portions of several lithium salar projects in northern Chile (Atacama, Quisquiro, Huasco and Ollagüe). Management intends to advance its Atacama Lithium Project in a strategic partnership with Uranium One with its sorption technology and the company’s strategic alliance with ENAMI. Wealth Minerals controls several lithium projects which encompass 67,200 hectares. The Lithium Triangle appears to be the global sweet spot for low-cost incremental supply of lithium. Wealth Minerals is also advancing several battery-metal opportunities with prospective copper, nickel, cobalt and vanadium projects

Management has been actively advancing the company’s initiatives over the last 12 months.

In anticipation of a supply shortage of lithium due to the dramatically increasing use of lithium battery technology, management remains primarily focused on lithium salar projects in Chile. Wealth Minerals is well positioned to be a beneficiary of this expected disparity in supply and demand.

• The announcement of a MOU with Uranium One could lead to a Definitive Agreement for a partnership that would accelerate the development of Wealth Minerals’ Atacama Lithium Project, including the use of Uranium One’s lithium extraction technology.

• A Pertinencia (or work program review affidavit) was received from the Chilean Environmental Agency for the company’s Atacama Project in August 2019. This key document allows for low impact exploration programs at the property.

• Negotiations under the MOU with ENAMI are anticipated to establish the terms of a definitive agreement by March 2020

• Prior to the date required by the option agreement, Wealth Minerals issued 250,000 shares to complete the requirements for 100% ownership of Flamenco and Vapor properties located at the Salar de Huasco and Salar de Ollagüe, respectively.

• In March 2019, Wealth Minerals acquired 100% of the 7,900-hectare Harry Project, located northeast and west of the company’s Atacama Property.

Similarly, management believes that other battery metals (such as copper, nickel, cobalt and vanadium) will benefit from the industry trend toward increased use of battery technology. Management has become aware of many prospective projects and has opportunistically invested in several battery-metal prospects.

• Wealth Minerals’ subsidiary, Wealth Copper Ltd., has acquired interests in the mineral exploration and exploitation concessions of two copper projects located in Chile

◦ Escalones Copper-Gold Porphyry Project

∙ Wealth Copper has acquired the underlying option agreement for the Escalones Project from TriMetals Mining by issuing 25,000,000 Wealth Copper shares and paying $150,000 of the required $1,000,000.

◦ Cristal Copper Property

∙ Wealth Copper has acquired the underlying option agreement for the Cristal Copper Property by issuing 50,000 Wealth Copper shares to New Energy Metals.

◦ Wealth Copper completed a private placement; gross proceeds were $814,000.

◦ Management continues to work on distributing Wealth Copper Ltd to the shareholders of Wealth Minerals. Wealth Copper continues to work on completing a transaction with a Capital Pool Company (Allante Resources Ltd.) in order to go public. Management expects the transaction to be completed by the end of 2019.

• Wealth Minerals entered into a formal option agreement to acquire the Kootenay Nickel-Cobalt-Copper Project in southeastern British Columbia

◦ Wealth Minerals announced a flow-through offering to finance an airborne VTEM and magnetic geophysical survey over 2,900 hectares of the Kootenay Project.

• Wealth Minerals entered into a formal option agreement to acquire a 100% interest in the 1,749-hectare Meductic Vanadium Properties, which are located in New Brunswick, Canada. Vanadium redox flow batteries are addressing the large -scale energy storage segment in the electric power industry, particularly for utility-scale, industrial and EV applications.

In a legacy property, after a seven-year negotiation effort, Wealth Minerals was granted access rights to Valsequillo Silver Project in Mexico.

MOU Signed with Uranium One

On October 15, 2019, Wealth Minerals announced the signing of a strategic MOU (memorandum of understanding) with Uranium One Group. Under the MOU, Uranium One would receive up to a 51% ownership interest in Wealth Minerals’ Atacama Lithium Project and would have the right to purchase up to 100% of the Atacama Project’s production in return for co-operation in the development of the Project, including the use of Uranium One’s lithium extraction technology at all of Wealth’s lithium salar projects. Uranium One is conducting due diligence on the technical, geological, legal, tax and financial aspects of the Project, which should lead to a Definitive Agreement.

Typically, lithium operations at salars use solar evaporation to concentrate lithium compounds from lithium-bearing brine, which has been brought to the surface. Uranium One has developed an in situ recovery (ISR) technology that extracts target minerals from ore bodies through leaching liquors (aka lixivants). The pregnant solution is transported to the surface and then processed in order to recover the minerals. Currently, Uranium One utilizes this technology (ISR mining) to extract uranium (U3O8) at the Zarechnoye Mine in Kazakhstan and at the Willow Creek Mine in Wyoming’s Powder River Basin. Uranium One’s ISR technology can be utilized to extract lithium compounds from lithium-bearing brine material through the use of a sorbent. This sorption technology would decrease both capital and operating costs, reduce the physical footprint of mining and processing operations and allow for the restoration of brine back into the salar.

Headquartered in Toronto, Uranium One is a Canadian mining company, which is a wholly-owned subsidiary of ROSATOM, a state-owned Russian corporation primarily focused on the nuclear production chain (uranium exploration, mining and enrichment; nuclear fuel fabrication; nuclear power plant design, construction, operation and decommissioning; and radioactive waste management).

Pertinencia for the Atacama Project

On August 15, 2019, Wealth Minerals announced the receipt of a Pertinencia (or work program review affidavit) from the Chilean Environmental Agency. This key document allows for low impact exploration programs at the Atacama Project. Based on the information presented by the company, the exploration work will not require an Environmental Impact Declaration or an Environmental Impact Study.

Strategic Alliance with ENAMI

On March 19, 2018, Wealth Minerals announced that the company had entered into an agreement with ENAMI (Empresa Nacional de Minería aka National Mining Company of Chile) to form a strategic alliance that should result in a JV partnership for the development and commercialization of Wealth Minerals’ Projects in the Salar de Atacama and Laguna Verde. Management anticipates that it will be 24-month process to formally form and efficiently structure the JV, which will be 90% owned by Wealth Minerals and 10% owned by ENAMI with free-carried interest.

Progress Report on Acquisition of Chilean Copper Assets & Transfer to Shareholders

Wealth Minerals is pursuing a path by which Wealth Minerals’ ownership in Wealth Copper will be transferred to the shareholders of Wealth Minerals through a business transaction with Allante Resources, a Capital Pool Company. The process is similar to business combination with a SPAC (Special Purpose Acquisition Company) in the United States by which a private company (in this case Wealth Copper) becomes a publicly-traded company while at the same time receives an influx of capital.

On June 7, 2019, Wealth Copper Ltd. (a private company and wholly-owned subsidiary of Wealth Minerals Ltd.) and Allante Resources Ltd. entered into a binding letter agreement to combine their respective businesses. Trading has been halted on ALL.H and will remain so until the transaction is completed.

Allante Resources is a Capital Pool Company whose principal business is the identification, evaluation and acquisition of a business in a Qualifying Transaction. Capital Pool Companies provide an alternative method for private companies to raise capital and go public in Canada.

Allante Resources is required to raise at least $2,000,000 through a private placement, which will be loaned to Wealth Copper at a 4% annual interest rate. Allante is also required to complete another private placement such that the combined gross proceeds of both financings will total at least $5,000,000. The net proceeds are expected to fund the exploration and development of the Cristal and Escalones Projects as well as to be used for general working capital.

There are several conditions on the completion of the transaction with Allante Resources Ltd:

• the transactions for the Cristal and Escalones Projects close

◦ completed in July and September, respectively

• the completion of Allante’s first private placement with gross proceeds of at least $2.0 million

◦ as of September 29, 2019, Allante is on track to complete private placement in an amount of at least $4,186,000

• the approval of the TSX-V that the acquisition meets the requirements of a Qualifying Transaction

• the TSX-V initial listing requirements are met for a Tier 2 mining issuer, including the preparation of a 43-101-compliant Technical Report that contains a recommended work program of at least $200,000

On September 27, 2019, Wealth Copper announced the closing of 8,140,000-share private placement priced at $0.10 per Wealth Copper share. Gross proceeds were $814,000. After closing the Cristal and Escalones option agreement acquisitions and the Wealth Copper private placement, Wealth Minerals owns 25,000,000 Wealth Copper Shares (42.6% of the total issued and outstanding shares of Wealth Copper Ltd.). After the proposed private placement of Allante Resources, it is anticipated that Wealth Minerals will own between 30% and 35% of Wealth Copper, which the Board/management plans on distributing to the shareholders of Wealth Minerals, possibly in the form of a stock dividend.

The management of Wealth Copper anticipates that the Going-Public Transaction will be completed in during the fourth calendar quarter of 2019.

Kootenay Nickel-Cobalt-Copper Project

On October 17, 2019, Wealth Minerals entered into an option agreement to acquire the entire Kootenay Nickel-Cobalt-Copper Project in south eastern British Columbia. The Kootenay Project consists of two separate claim blocks: the 6,136-hectare Lardeau Property and 1,728-hectare Ledgend Property.

Lardeau Property

Regional stream sampling programs conducted by the British Columbia Ministry of Mines have detected anomalous nickel-cobalt silt anomalies in the area. The Lardeau Property was originally staked due to these Ni-Co anomalies.

In the fall 2017, a previous operator under an option agreement, Cardero Resource Corp., completed a soil sampling program in fall 2017. The program included 126 silt samples from numerous small creeks, three of which exhibited highly anomalous nickel (>100 ppm), cobalt (>30 ppm) and copper (>50 ppm) values. Also, reconnaissance work along the access roads identified listwanite float (siliceous iron carbonate), which is associated with nickel-cobalt mineralization and also with massive sulphides at the standard VMS (Volcanogenic Massive Sulphide) deposits.

Given the presence of indicator minerals (nickel-cobalt anomalies and listwanite float), management believes there is the excellent potential for the discovery of Cu-Zn-rich VMS deposits with significant nickel-cobalt content. Management intends conduct a helicopter-borne VTEM and magnetic geophysical survey over 2,900 hectares of the Lardeau Property.

Ledgend Property

The first documented massive sulphide showing in the Kootenay region was on the Ledgend Property when in 1981, during construction of a logging road, Mike Hudock made the discovery. However, mineral claims in the area were not staked until May of 1997 in the name of Ken Murray. The staked occurrence was described as a “massive pyrrhotite with locally massive pyrite forming an outcrop approximately 21 feet long by 3 to 4 feet thick.” In 1998, Tom Schroeter, a British Columbia Geological Survey geologist, described a showing as “massive pyrrhotite with local massive pyrite occurs over a one by six meter outcrop in a stream bed.”

In 2016, Cardero Resource Corp. conducted an exploration program consisting of 392 soil samples. Contouring the data, a north‐northwesterly anomaly was detected and the data displayed an association between nickel and cobalt. In October 2017, Cardero completed a soil, silt and rock sampling program during which a large outcrop was discovered. Chip samples over four meters graded 0.22% nickel and 161ppm cobalt. The soil grids generated by the 2016 and 2017 campaigns outlined three significant Nickel-Copper anomalies, with two being open to the north.

In May 2018, a drone airborne magnetometer geophysical survey was flown over approximately 375 hectares for the purpose of detecting the sulphide horizon. The survey outlined a 1,200-meter anomaly, which corresponded with nickel, cobalt and copper soil geochemical anomalies. An Assessment Report dated 2018 recommends that the significant Ni-Co-Cu-Zn anomalies be mapped, trenched and sampled. Also an aero-magnetic survey (UAV and preferably combined with LiDAR) is also recommended.

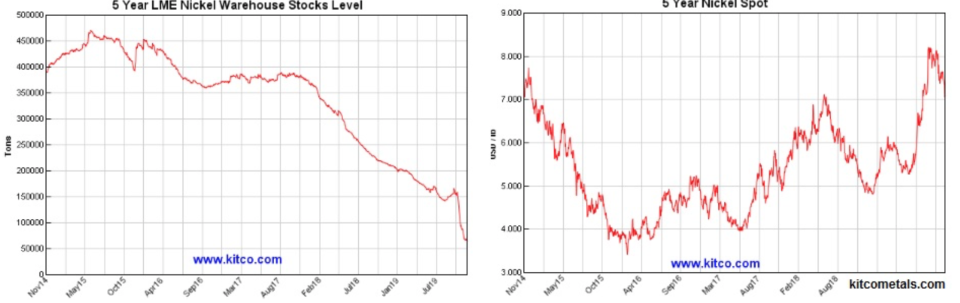

LME nickel inventories have declined by 80% to approximately 77,000 metric tons (or less than two weeks of global nickel consumption) since the beginning of 2018. Though stainless steel remains the primary market for nickel (about 72% of global nickel production), EVs now account for 4% of total global nickel consumption.

Valsequillo Silver Project

On October 30, 2019, Wealth Minerals reported that surface access rights to the Valsequillo Silver Project have been secured through a successful negotiation process. Wealth Minerals has the option to acquire a 100% interest in the 2,840-hectare Valsequillo Silver Property, which is located in north-central Mexico, approximately 40 kilometers southeast of Hidalgo Del Parral. The company originally optioned the property in February 2012, and conducted preliminary exploration activities (176 grab samples) that year. Two significant north-northwest trending structural corridors were identified, both of which had extensive artisanal mine workings that followed epithermal, quartz-sulphide veins, which contained zinc, lead, copper and silver. Assay values from the samples obtained both from outcrops and dumps were promising with average vales of 0.15 g/t gold, 34 g/t silver, 0.28% copper, 0.52% lead and 0.5% zinc.

Subsequently, access to the property was denied, and exploration activities ceased. The original 2012 option agreement was renegotiated in October 2015. The new option agreement tied the timing of the option payments to the company’s ability to obtain the necessary surface access. The property appears to be unexplored by modern methods; now that surface access rights have been secured, management is planning a high impact exploration program, including sampling, trenching and ultimately drilling.

Headquartered in Vancouver, British Columbia, Wealth Minerals Ltd is a junior exploration company that has a portfolio of highly prospective lithium-brine mineral concessions located within the Lithium Triangle. Management has positioned the company to benefit from the upcoming expected growth of demand in the lithium space. Management became aware of many prospective battery-metal (copper, nickel, cobalt and vanadium) opportunities through its constant exposure to deal flow in Chile and has opportunistically invested in two copper prospects through Wealth Copper Ltd., along with the Kootenay Nickel-Cobalt-Copper Project and the Meductic Vanadium Properties.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks provides and Zacks receives quarterly payments totaling a maximum fee of $30,000 annually for these services. Full Disclaimer HERE.