Wood Construction customer ‘would like for him to go to jail’

NASHVILLE, Tenn. and COLUMBIA, S.C. (WJHL) — Former Wood Construction Co. owner Joe Wood’s bankruptcy lawyer is in a legal tussle with the Tennessee Attorney General’s (AG) office, which is now seeking $2.1 million in restitution on behalf of 94 consumers.

The AG wants what’s called a default judgment in the lawsuit it filed against Wood last August. Wood’s bankruptcy attorney claims that shouldn’t be allowed because, until the conclusion of a bankruptcy, debtors are protected by an “automatic stay” against separate judgment. Wood filed for bankruptcy protection in South Carolina on Oct. 21, 2023, two months after the AG filed its lawsuit.

Heritage Alliance preserves Jonesborough’s Duncan House thanks to grant funding

One of Wood’s former customers who says her family lost more than $158,000 to him applauded the AG’s recent action, though Maisy Yeager added that she doesn’t expect to see any of her money and that she “would like for him to go to jail.”

A Kingsport bankruptcy attorney who helped explain the purpose of the automatic stay meanwhile called the AG’s move “fairly bold.” But Dean Greer added that when it comes to the Wood case, “everything about it has a sense of stink to it because of the way it was handled.”

Wood, through his now-closed home remodeling business, is accused of ripping off dozens of homeowners by taking deposits, many times in higher-than-allowed amounts, then not performing the work promised. Most of the contracts are from 2020 and 2021.

A Tuesday filing in Davidson County Chancery Court lists specific amounts the AG has determined Wood Construction owes the former customers, including more than four dozen whose names and credit amounts Wood did not include in his own bankruptcy filings. It asks a judge to rule that Wood should pay $2,060,318.22 in restitution to 94 different customers, along with $94,000 to the state for 94 separate violations of the Tennessee Consumer Protection Act.

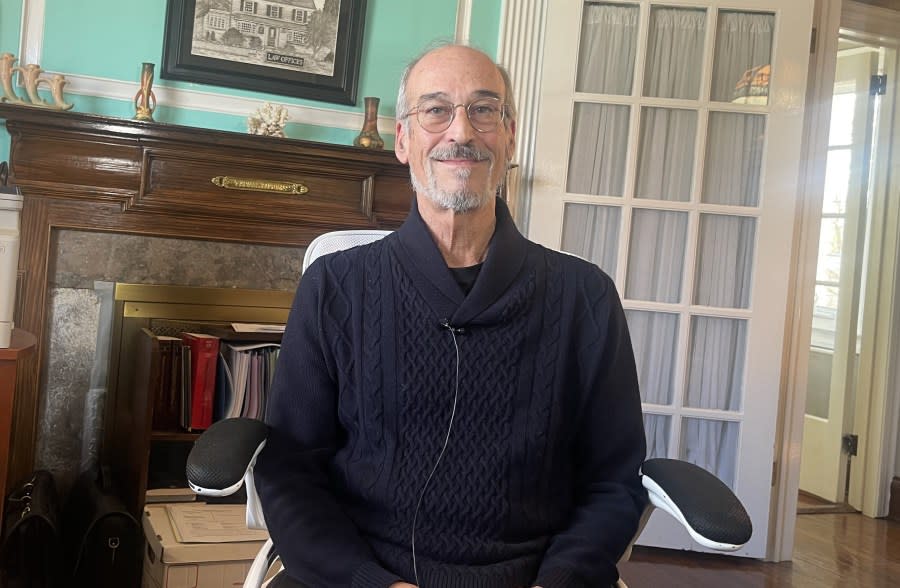

“It’s nice to know that the State of Tennessee is finally starting to progress on their complaint with Wood,” Fall Branch homeowner and former Wood Construction customer Maisy Yeager told News Channel 11 Monday. While Wood did not list Yeager and her husband as creditors in his Oct. 21, 2023 bankruptcy filing in South Carolina, their $158,813 claim is the highest listed in the AG’s recent filing.

“Justice is slow in this, we recognize that, so it’s nice to see that we’re making some progress,” Yeager said.

AG Jonathan Skrmetti sued Wood and his company on Aug. 21, writing at the time that “Wood Construction took millions of dollars from homeowners in Tennessee and North Carolina without delivering the services it promised.”

Exactly two months later Wood and his wife Cameron filed for Chapter 11 bankruptcy protection in South Carolina, where they have lived for nearly two years. According to the AG’s Tuesday motion, Wood has “failed to answer, respond, or otherwise defend against the State’s Complaint.”

In its motion Tuesday, the AG claimed “Mr. Wood’s default appears to be a strategy to avoid the fact-finding process and evade responsibility for the consumer injury caused by his and Wood Construction’s actions.”

If a judge upholds the motion, Wood and Wood Construction would owe $2.1 million in restitution, $94,000 to the state, and face several other punishments including an injunction against doing business in Tennessee in the future.

Not so fast, Wood’s attorney says

Robert Pohl, who represents Wood in his bankruptcy case, filed a separate complaint Tuesday in South Carolina Bankruptcy Court claiming that the “automatic stay” rule in bankruptcy should apply and prevent any judgments during the bankruptcy process.

Greer, the Kingsport attorney, said the automatic stay is designed to protect a debtor’s assets so the process can play out fairly. For instance, the homeowners Tennessee represents are among dozens of creditors, some with secured debt.

The automatic stay, Greer said, can “protect the assets of the estate from being gathered up all by one creditor for their claim when there are a lot of other creditors.”

The AG’s motion claims Tennessee is exempt, citing a section of bankruptcy law overriding the stay for governmental units through their “police and regulatory power.” The state’s motion for default judgment says “Wood and Wood Construction’s failures are not the result of excusable neglect.”

Pohl responded that the state didn’t meet either of the two standards to qualify for exemption from the stay. He wrote that since Wood Construction is defunct, the Woods no longer pose any threat to consumers and that the Woods need “time to gather and obtain the documentation and information to respond to the allegations set forth in the Civil Complaint and other lawsuits.”

Pohl wrote that the Woods “filed bankruptcy to consolidate all of the pending litigation in the organized and orderly process provided by the U.S. Bankruptcy Code.”

But even in their bankruptcy, the Woods have tried the patience of the trustee assigned to oversee it. Gerard Vetter filed a motion in the bankruptcy case on Dec. 18 asking that a judge convert it from a Chapter 11 (business reorganization) to a Chapter 7.

Trustee says Wood Construction owners abusing bankruptcy process

“The Debtors’ strategy is unfair to their many creditors, who have been thus far deprived due process in this case, and is an abuse of the Bankruptcy process,” Vetter wrote. Monday, an order was placed converting the case to Chapter 7 that said “the debtors have provided their consent” to the conversion.

Chapter 11 ‘not a refuge for people who just want to avoid debts’

Greer, the Kingsport attorney, said bankruptcy laws are an important protection for consumers.

“We live in a very turbulent economy, we live in an economy where credit is pushed all over the place, and routinely I deal with people who need to file bankruptcy, but I have only rarely found someone who wanted to file bankruptcy,” he said.

Those consumer cases see a trustee appointed by the bankruptcy court take control of the debtor’s assets, selling them to help pay creditors.

A Chapter 11 reorganization is different, Greer said. In it, a debtor, often a business, takes care of their own plan under court supervision — usually with an eye toward re-emerging to do business again.

“You’re given a chance to rehabilitate yourself and either get back on your feet as a business or to sell your assets at the best price to pay as much as you can on your debts,” Greer said.

Blue Circle Drive-In reopens Tuesday in Bristol, Tennessee

In his review of the Wood case, Greer said he was struck by how few assets were reported.

“I have real questions as to why Chapter 11 was proposed in the first place because there doesn’t seem to be anything to sell,” he said. “I’m not sure what sort of plan that they would present to rehabilitate this.”

In the Wood case, at least according to Chapter 11 Trustee Gerard Vetter, the Woods failed to cooperate with even the simplest steps of Chapter 11, including by not providing addresses of more than 40 remodeling clients who are owed their deposits.

Greer said that apparent unwillingness to obey normal Chapter 11 rules was one reason “everything about it has a sense of stink to it simply because of the way it was handled,” before he rattled off a laundry list of what could be seen as bad faith actions.

“Very little paperwork initially shown. A large number of creditors who can’t be identified by any address. A very small amount of assets available to pay debts once you consider liens against them. The conduct of the debtors in asserting the Fifth Amendment all the way through, which just basically gums up the process.”

“Chapter 11 is supposed to be a voluntary resolution of your financial problems under the guidance of the court. It’s not a refuge for people to just avoid debts.”

‘I would like for him to go to jail’

Now settled in a remodeled farmhouse after a delay of about three years, Maisy Yeager said she’s not expecting to see any of the $158,000 the AG claims Wood Construction owes her. She is, however, grateful for the continued attention the AG and others have put on the case — even though she learns the latest through the media.

“It’s catch 22,” Yeager said. “Either we say we want them to communicate or we want them to pursue their complaints. Let’s pursue the complaints, we’ll figure out how to do the communication.”

An affidavit from Maria Strohbehn, the assistant AG in the Consumer Protection Division who has led the investigation into Wood Construction, seems to show her office definitely pursuing the complaints.

While Wood seemed unable to include the names, addresses and amounts paid by dozens of creditors, her office managed to find that information. Strohbehn wrote that she began investigating Wood and his company in October 2021, after “a plethora of complaints” customers submitted to the AG’s office.

Wood responded to written requests in December 2021, informing the AG’s office that a company called Builder Prime, which provides project management software for building contractors, had handled Wood Construction’s billing.

Builder Prime responded to a request from Strohbehn and provided a spreadsheet of payments made by consumers to Wood Construction. Those digital folders also “contained consumers’ receipts and photographs of personal checks.”

From that information, Strohbehn was able “to determine the amount of money owed to specific consumer complainants.”

Yeager is left with an unfinished job, even though she and her husband have moved in. Some of the rooms don’t even have doors.

“It’s kind of bittersweet because we’re in it and we’re living in it and we’re utilizing it as best we can, but it’s still not done,” she said.

The home’s windows offer one tangible reminder of Wood’s impact.

“They were installed, but they were never flashed, they were never caulked,” Yeager said. “So when the people came behind them to do some of the work that we thought all of that stuff was done, we’re now finding (it wasn’t).”

“All the windows around the frames used to leak — every window on that side of the house,” she said, pointing to the windward side of the home. A new contractor has done what they can, but because the clapboard and siding are already in place, “we’ve addressed that, but not in the way it should have been addressed.”

Yeager doesn’t expect to see a windfall that could pay for ripping off the siding and completely replacing the windows, or funding a few interior doors. In his Chapter 11 filing, the Woods listed known secured debts exceeding their listed assets.

“The payouts rarely happen,” she said, adding that “realistically, I wrote that off a long time ago.”

But Pohl, the Woods’ attorney, noted in a December bankruptcy filing that Joe Wood had a criminal defense attorney and was in negotiations with a U.S. Attorney over potential criminal charges.

“I would like for him to go to jail,” Yeager said. “If he goes to jail … if he’s held accountable and has to serve some time, I think that will help with the closure.”

Hidden assets?

Wood Construction collected millions of dollars for work that authorities allege it didn’t do. Whether any of that money could be squirreled away somewhere remains an open question.

Vetter, the bankruptcy trustee, wrote that though they’re required to, the Woods haven’t filed a required report about financial information about entities in which they hold “a controlling or substantial interest.”

The Woods list a total of 18 entities but have not filed a report on those. One of them, “Range 1 Equities,” was also listed as the source of Joe Wood’s monthly income this calendar year.

Vetter seemed to hint that the court should try to get to the bottom of that matter.

“(T)he recalcitrance of the Debtors in providing any testimony as to their financial affairs supports a Chapter 7 Trustee being appointed to investigate insider payments and fraudulent transfers,” Vetter said.

Greer said if indeed the Woods are trying to unethically shield themselves in the Chapter 11 process, “there’s always that hope” of a Chapter 7 trustee uncovering additional assets.

“Oftentimes in situations like this, you find out the coffers have already dried up and everything that once was there is now gone,” Greer said. “But you do occasionally find debtors in bankruptcy who actually hid assets in order to game the system.”

He said it’s illegal to transfer assets ahead of a bankruptcy filing. With the case now a Chapter 7, the state or individual creditors could potentially sue for their claims, but they’d have to do it in South Carolina, Greer said. So could the Chapter 7 trustee, working on behalf of creditors.

“There’s a lot of things a trustee can do, but they are not government agents,” Greer said. “Chapter 7 trustees are independent contractors and oftentimes a Chapter 7 trustee may lack the resources to adequately pursue a very complicated case.”

That may leave only the criminal side in terms of customers seeing justice.

“Other than their comments that they’re under an investigation and talking to the United States Attorney I don’t have any indication of what may be being looked at, but there could be state criminal proceedings in the state of Tennessee,” Greer said.

“It is a criminal act for a contractor to take your money and then supply no goods. It doesn’t mean they committed a crime but it is a presumption that they may have committed a crime and they have to have a good explanation to escape criminal prosecution.”

The Tennessee Attorney General’s office declined to comment on their latest motion, as did Pohl, the Woods’ bankruptcy attorney, on his.

For the latest news, weather, sports, and streaming video, head to WJHL | Tri-Cities News & Weather.