Some World-Link Logistics (Asia) Holding (HKG:6083) Shareholders Have Taken A Painful 75% Share Price Drop

As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of World-Link Logistics (Asia) Holding Limited (HKG:6083), who have seen the share price tank a massive 75% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And more recent buyers are having a tough time too, with a drop of 45% in the last year. Unfortunately the share price momentum is still quite negative, with prices down 8.9% in thirty days. But this could be related to poor market conditions -- stocks are down 4.6% in the same time.

Check out our latest analysis for World-Link Logistics (Asia) Holding

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, World-Link Logistics (Asia) Holding actually managed to grow EPS by 16% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 2.0% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 4.0% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching World-Link Logistics (Asia) Holding more closely, as sometimes stocks fall unfairly. This could present an opportunity.

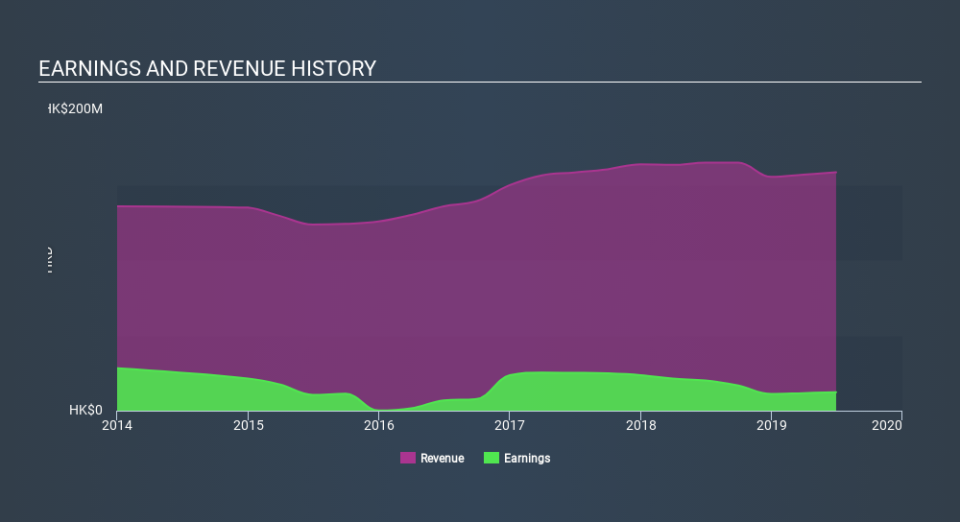

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for World-Link Logistics (Asia) Holding the TSR over the last 3 years was -73%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Over the last year, World-Link Logistics (Asia) Holding shareholders took a loss of 42% , including dividends . In contrast the market gained about 0.7%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 35% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.