Worried Markets Want to Believe a Debt-Ceiling Deal Can Be Done

(Bloomberg) -- There are still some optimists in the market confident that a solution will be found in time to the US debt-ceiling crisis even as the Washington stalemate persists and many investors shun the most at-risk Treasury-bill issues.

Most Read from Bloomberg

Hedge Funds Drive Credit Suisse CDS Higher on Bets of a Payout

Steve Schwarzman Holds Off Giving Money to DeSantis After Meeting Him

Abu Dhabi Royal’s Firm Shorts US Stocks on Global Recession Fears

Family Builds $900 Million Brazil Farming Empire After 935% Gain

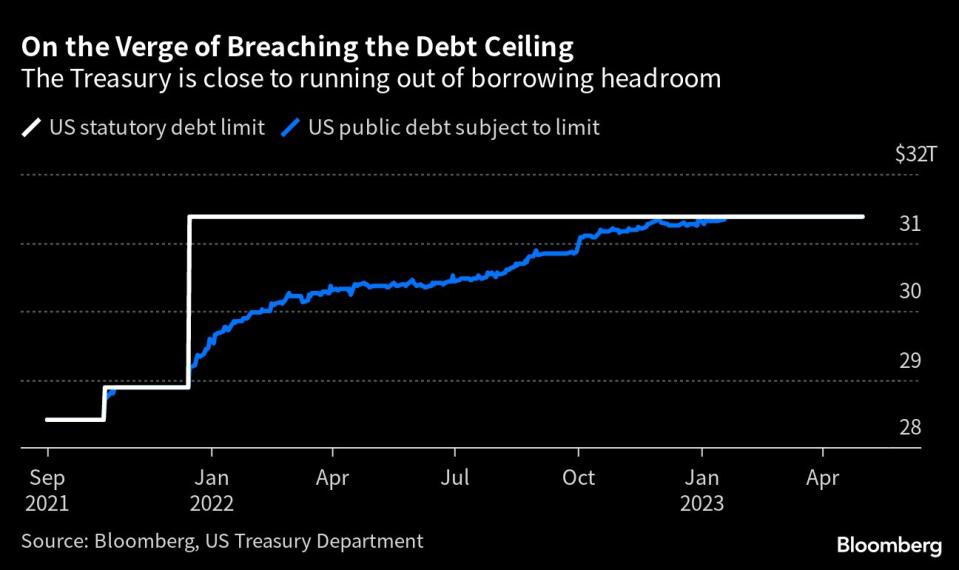

The window for averting a potential default is narrowing by the day, and although talks between President Joe Biden and House Speaker Kevin McCarthy on Tuesday yielded little, they are scheduled to meet again on Friday. Treasury Secretary Janet Yellen has flagged the risk that the US could run out of borrowing headroom as soon as early June and many investors have said that the risks are greater even than in 2011, when a narrow miss on the debt ceiling led Standard & Poor’s to strip the US of its top credit rating.

But there are many in financial markets predicting or hoping that some kind of deal will get done — in part because that’s what’s always happened, even when things have gone down to the wire.

Money manager Janus Henderson this week pegged the probability of an outright default on Treasuries at less than 1%. Prominent investor Bill Gross, who used to run the world’s biggest bond fund at Pacific Investment Management Co., has labeled the whole situation “ridiculous” and advised people to buy short-end T-bills on the expectation that a fix will probably be found. And it appears that there are some in the market willing to scoop up bills in the debt-ceiling danger area to get the extra yield they offer despite the ticking clock.

While last week’s auction of four-week securities — the shortest-maturity Treasury benchmark — saw investors demand a record-high yield of 5.84%, the pre-sale trading level for this Thursday’s offering at that tenor is currently more than 30 basis points lower than that. That’s still elevated relative to many other parts of the bills curve, of course, and part of that may also reflect shifts in the offering size and monetary policy expectations. It nevertheless shows that appetite has improved even as the deadline draws nearer.

From Washington to Wall Street, here’s what to watch to gauge how worried observers should be and when they should be concerned.

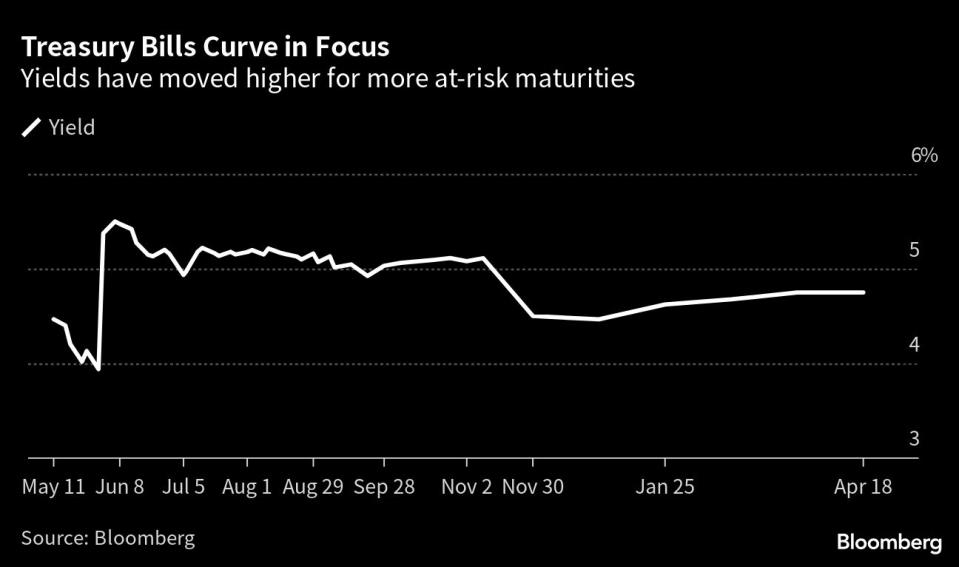

The Bills Curve

Investors have historically demanded higher yields on securities that are due to be repaid shortly after the US is seen as running out of borrowing capacity. That puts a lot of focus on the yield curve for bills — the shortest-dated Treasury securities — and potential dislocations that show up. Noticeable upward distortions in particular parts of the curve tend to suggest increased concern among investors that that’s the time Uncle Sam might be at risk of default and right now that’s most prominent around early June.

Curvature Securities’ Scott Skyrm calculated earlier this week that the yield on some early June securities implied that the market was pricing in a delay of around four to five days in payment on those instruments. That suggests investors still expect to get paid eventually, just not necessarily in a timely manner. Such an occurrence would nevertheless likely be classified as a default and the broader financial-market implications much larger than just a delayed payment for a few bill holders if it did come to that.

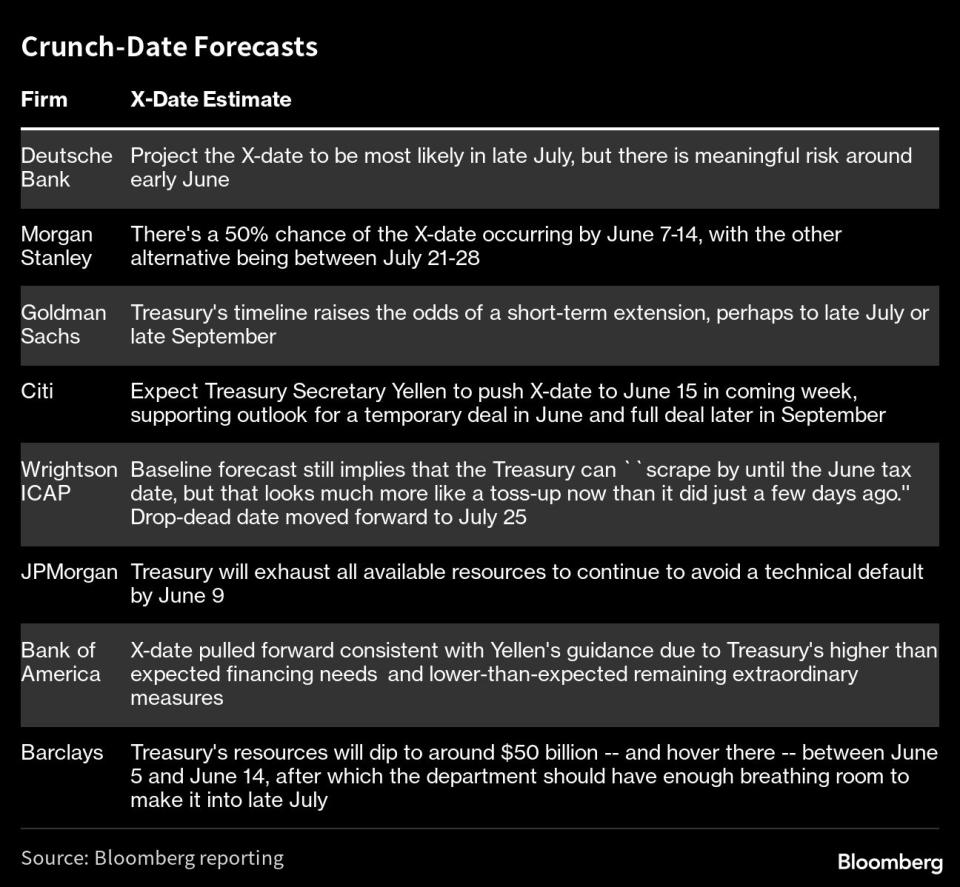

X-Date Predictions

Underpinning the various moves in debt markets are differing estimates about when the government might exhaust its options to fund itself — commonly referred to as the X-date. While the administration itself has provided guidance that it might fall short as soon as June, prognosticators across Wall Street have also been busy running the numbers based on government cash flows and expectations around tax and spending. Some strategists have pulled forward their estimates to align more with forecasts out of Washington. Others, meanwhile, are staying with their late-summer estimate, although recent cash flows from the Treasury suggest that it’s even more uncertain whether it will make it until June 15, a key tax payment day.

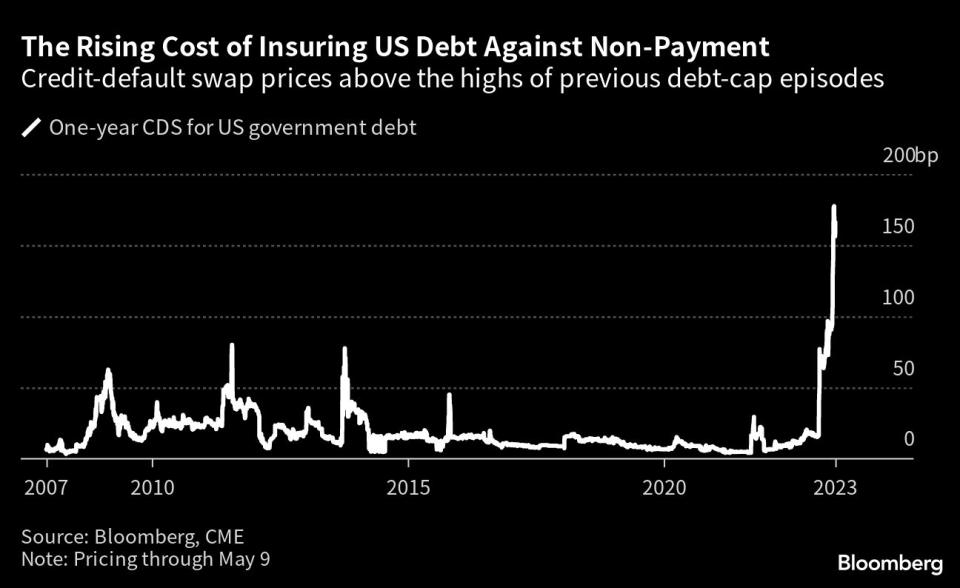

Insuring Against Default

Beyond T-bills, one other key market to watch for insight on ceiling risks is what happens in credit-default swaps for the US government. Those instruments, which act as insurance for investors in cases of non-payment, have continued to lurch to new highs. The cost to insure US debt is now higher than the bonds of — among others — Greece, Mexico and Brazil, which have defaulted multiple times and have credit ratings many rungs below that of the US’s.

Related Story: US Default Insurance Cost Eclipses Brazil, Mexico as X-Day Nears

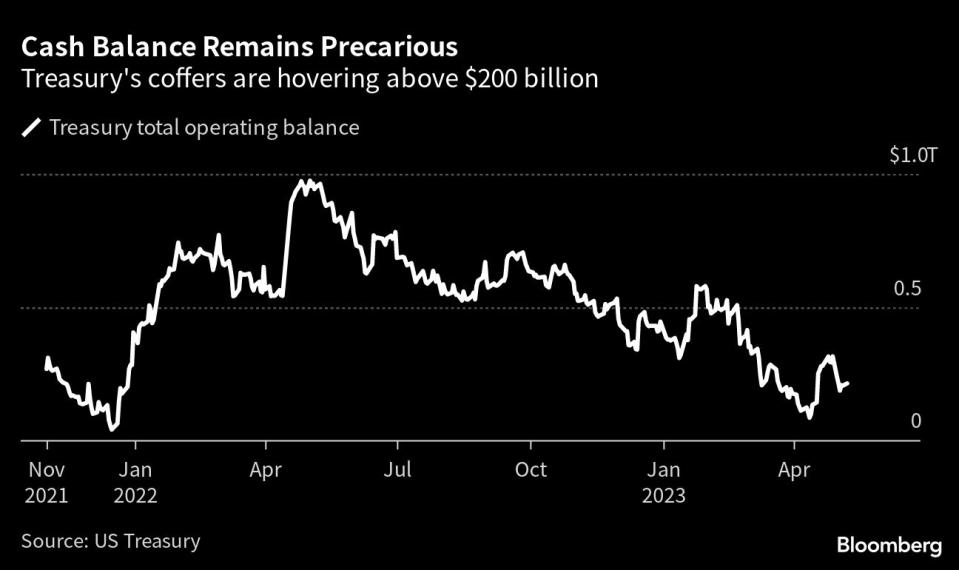

The Cash Balance

The US government’s ability to pay its debts and meet its spending obligations ultimately comes down to whether it has the cash to do it, so the amount sitting in its checking account is crucial. That figure ebbs and flows from day to day depending on spending, tax receipts, debt repayments and the proceeds of new borrowing. And if it gets too close to zero for the Treasury Department’s comfort that could be a problem.

MLIV Pulse Survey: Are the odds of a US default this time higher than in 2011? Share your views here.

Wrangling in Washington

Ultimately though, any fix will need to come from Washington. There is a very small number of days this month when both chambers of Congress are available and Biden is also scheduled to be in the US capital, meaning there isn’t a lot of time to waste to get something done before the X-date. Further negotiations are expected between congressional and presidential aides ahead of the next meeting of the leaders on Friday.

Related Story: Biden, McCarthy Vow More Debt-Limit Talks as US Default Looms

--With assistance from Alex Harris and Michael Mackenzie.

Most Read from Bloomberg Businessweek

The Plot to Steal the Other Secret Inside a Can of Coca-Cola

AI Drug Discovery Is a $50 Billion Opportunity for Big Pharma

‘Nearshoring’ Push Is Fueling Tech Job Demand in Latin America

©2023 Bloomberg L.P.