Should You Worry About IDG Energy Investment Limited's (HKG:650) CEO Salary Level?

Jingbo Wang became the CEO of IDG Energy Investment Limited (HKG:650) in 2016. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we'll consider growth that the business demonstrates. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for IDG Energy Investment

How Does Jingbo Wang's Compensation Compare With Similar Sized Companies?

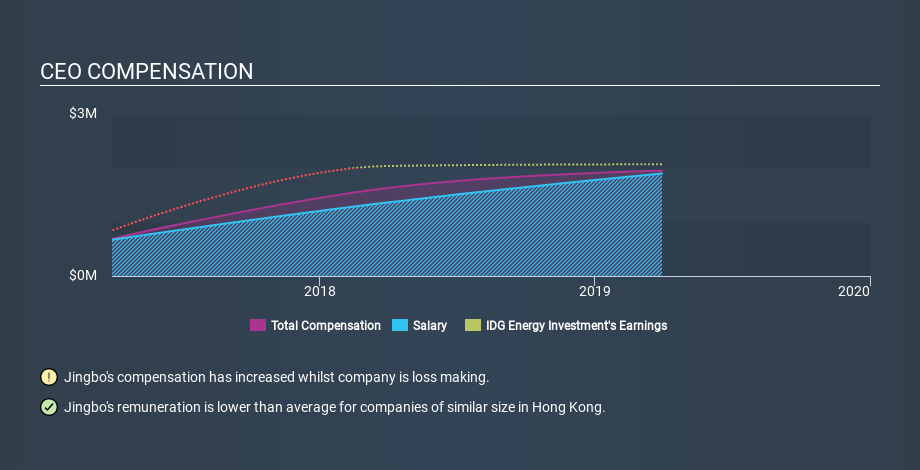

Our data indicates that IDG Energy Investment Limited is worth HK$5.3b, and total annual CEO compensation was reported as HK$1.9m for the year to March 2019. It is worth noting that the CEO compensation consists almost entirely of the salary, worth HK$1.9m. We looked at a group of companies with market capitalizations from HK$3.1b to HK$12b, and the median CEO total compensation was HK$3.4m.

A first glance this seems like a real positive for shareholders, since Jingbo Wang is paid less than the average total compensation paid by similar sized companies. While this is a good thing, you'll need to understand the business better before you can form an opinion.

You can see, below, how CEO compensation at IDG Energy Investment has changed over time.

Is IDG Energy Investment Limited Growing?

IDG Energy Investment Limited has increased its earnings per share (EPS) by an average of 127% a year, over the last three years (using a line of best fit). In the last year, its revenue is up 6.4%.

This shows that the company has improved itself over the last few years. Good news for shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has IDG Energy Investment Limited Been A Good Investment?

With a three year total loss of 70%, IDG Energy Investment Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

It looks like IDG Energy Investment Limited pays its CEO less than similar sized companies.

Considering the underlying business is growing earnings, this would suggest the pay is modest. Despite some positives, it is likely that shareholders wanted better returns, given the performance over the last three years. We're not critical of the remuneration Jingbo Wang receives, but it would be good to see improved returns to shareholders before the remuneration grows too much. When I see fairly low remuneration, combined with earnings per share growth, but without big share price gains, it makes me want to research the potential for future gains. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at IDG Energy Investment.

If you want to buy a stock that is better than IDG Energy Investment, this free list of high return, low debt companies is a great place to look.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.