Xerox Pulls Out of $35 Billion Hostile Bid For HP

U.S. printer maker Xerox Holdings Corp (XRX) abandoned its $35 billion hostile cash-and-stock takeover for HP Inc (HPQ), citing the volatile market and the economic crisis triggered by the coronavirus outbreak.

“The current global health crisis and resulting macroeconomic and market turmoil caused by COVID-19 have created an environment that is not conducive to Xerox continuing to pursue an acquisition of HP,” Xerox said in a statement.

Xerox maintained though that there were compelling long-term financial and strategic benefits from combining Xerox and HP.

“The refusal of HP’s Board to meaningfully engage over many months and its continued delay tactics have proven to be a great disservice to HP stockholders, who have shown tremendous support for the transaction,” Xerox said.

Read More: HP Tells Shareholders: Now Isn’t the Time For Merger with Xerox

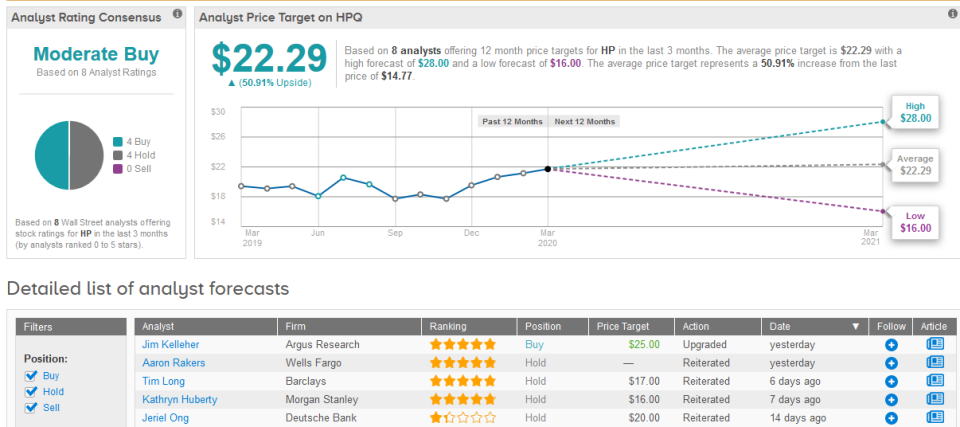

The analyst community is taking a cautious stance on recommending to buy Xerox and HP as both stocks get a Moderate Buy consensus rating. In the case of Xerox, the consensus rating is based on 2 Buys and 1 Hold. For HP, analysts are evenly split into 4 Buys and 4 Holds.

Xerox’s $31 average price target would provide investors with a 77% yield should it be met. (See Xerox’s stock analysis on TipRanks)

The average price target of $22.29 for HP suggests a potential gain of 51% in the coming 12 months. (See HP’s stock analysis on TipRanks)

Related News:

Billionaire Investor Howard Marks Believes Now Is The Time To Buy (But Not Too Much)

Tower Semiconductor Bucks Downhill Trend By Reaffirming Q1 Guidance and Growth Rate

Judge’s Record Looks Unpromising for Amarin’s Appeal; Analyst Remains Bullish