Xerox Surpasses 4th-Quarter Estimates and Continues HP Bid

On Jan. 28 before market open, Xerox Holdings Corp. (NYSE:XRX) posted earnings for the fourth quarter and full year ended Dec. 31, 2019.

For the fourth quarter, revenue came in at $2.44 billion compared to $2.48 billion in the prior-year quarter, while adjusted earnings per share were $1.33 compared to 94 cents in the prior-year quarter. Analysts were expecting revenue of $2.39 million on earnings per share of 26 cents.

For the full year, the printing products and services company reported adjusted earnings of $3.55 per share (up 67 cents year over year) on $9.07 billion in revenue (down 6.7% year over year).

Prices were up 5.68% to approximately $37.03 in early afternoon trading following the news. As of Jan. 28, the company has a market cap of $8 billion, a price-earnings ratio of 13.03, a cash-debt ratio of 0.19 and a dividend yield of 2.7%.

Plans for growth

As of the end of 2019, Xerox's earnings success is mainly the result of cost-cutting efforts rather than growth. The company saved $640 million in its enterprise-wide initiative to simplify operations so that it could reinvest in the business and return 72% of free cash flow to shareholders through dividends and share buybacks.

"We are delivering on our three-year plan," CEO and Vice Chairman John Visentin said in the earnings report. "We grew earnings per share, increased cash flow and expanded adjusted operating margin for the full year, and we improved our revenue trajectory in the second half of the year as our investments in the business gained traction."

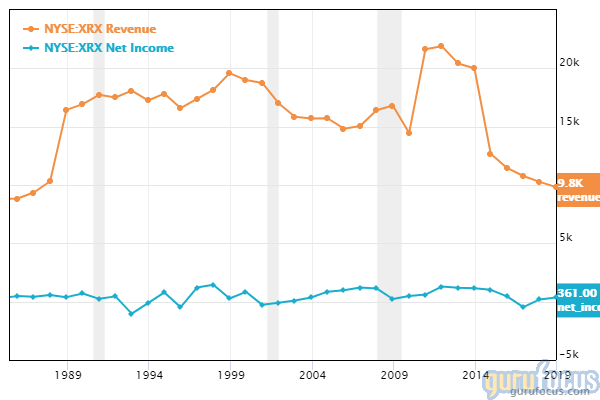

As you can see in the chart below, the company has maintained its net income at approximately the same levels in recent years, despite revenue declines.

Over the past three years, Xerox's revenue has declined at an annual rate of 2.9%, while its earnings per share without non-recurring items has declined 22.5%.

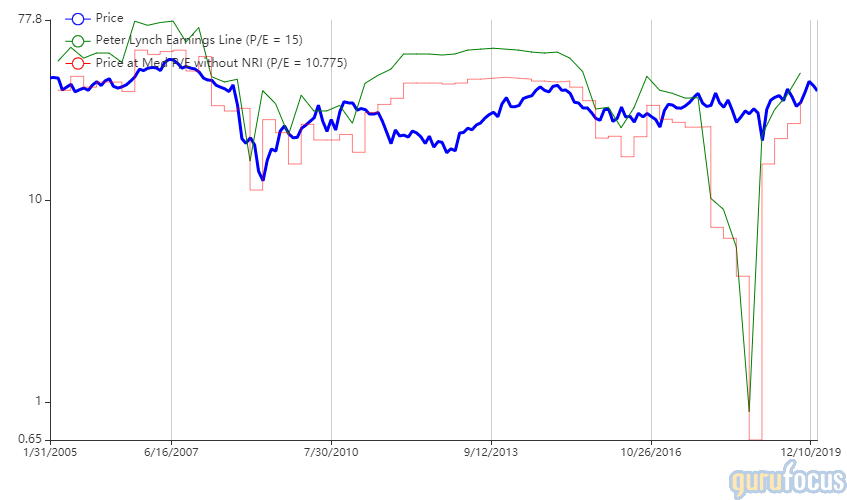

The company's plans for growth center around cutting costs, developing IT infrastructure and improving technology such as 3-D printers. Despite the company's success in maintaining profitability in light of declining revenues, it may not be poised for strong growth anytime soon given that most growth is expected to come from cost-cutting measures. Due in large part to this, Xerox is trading around its intrinsic value according to the Peter Lynch chart.

HP bid

Xerox is continuing its efforts to acquire HP Inc. (NYSE:HPQ), the computer giant that also serves as its principal rival in the printing business. Given Xerox's current lack of strong drivers for future growth, which limits its opportunities to create shareholder value, it has long been considering merging with its larger rival.

HP's lack of interest in acquiring its rival prompted Xerox to make its own bid in November of 2019, offering $17 in cash and 0.137 Xerox shares for each HP share, or approximately $24.7 billion in cash and 48% of the combined company. HP summarily rejected the offer and declined to negotiate the matter.

From an investor standpoint, a merger between the companies would be attractive. Xerox shareholders would be able to own part of a company with better growth prospects, while HP shareholders would benefit from a revenue boost and the elimination of their only major rival in printing. Activist investor Carl Icahn (Trades, Portfolio), who owns 10.85% of Xerox common shares and 4.24% of HP common shares, continues to lobby for a deal between the two companies.

The latest news regarding this matter is that on Jan. 23, Xerox nominated a slate of directors for HP's board election. HP shareholders will vote on the board of directors at the company's 2020 annual meeting of shareholders. HP's executives issued the following statement about the proposal:

"We believe these nominations are a self-serving tactic by Xerox to advance its proposal, that significantly undervalues HP and creates meaningful risk to the detriment of HP shareholders."

Looking forward

For current Xerox shareholders, it's a wait-and-see period. The company's shares are trading close to its intrinsic value, and any sort of deal that could be reached with HP would likely turn a good profit.

Unfortunately for shareholders, HP seems openly hostile to the idea of acquiring or being acquired by its rival, likely because its strong computer sales make the idea of expanding the lower-potential printing business seem like a waste of resources.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful analysis or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.