Xerox's Bid for HP: Could Consolidation Return Profits to Printing?

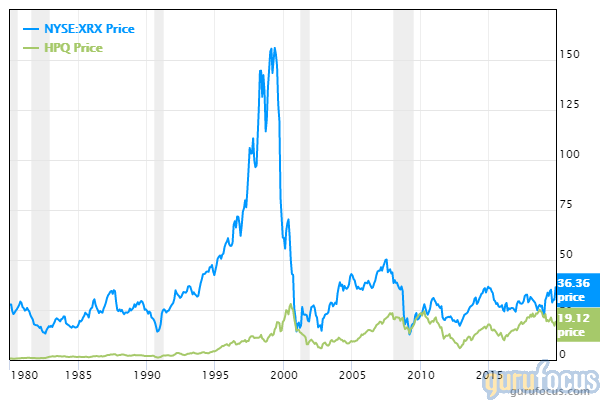

Ever since the Xerox Holding Corp. (NYSE:XRX) bubble burst in 1999, the price of the company's stock has been ranging around an invisible line in the mid-$30s, not going much of anywhere unless you bought it at the bottom of its recession low in 2008. Its main competitor in the printing industry, HP Inc. (NYSE:HPQ), has been in a similar situation, ranging around $10 to $20 per share since 2001.

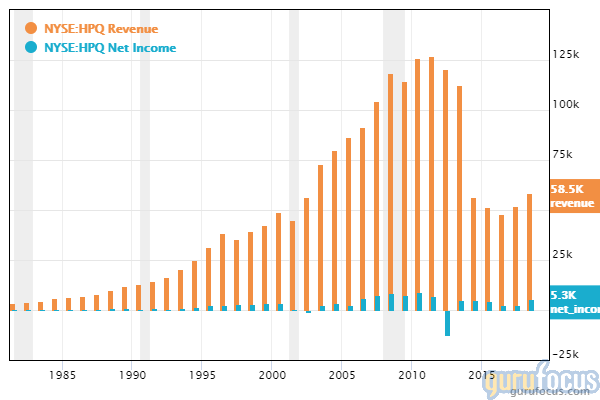

While Xerox sells printers, printing supplies and copiers, HP has branched out to become the number one PC seller in the U.S. in addition to selling printers and printing supplies. However, despite the fact HP's PC business brings in more revenue than the printing business does ($37.7 billion versus $20.8 billion for fiscal 2018), it actually brings in less operating income ($1.41 billion versus $3.32 billion), meaning that most of the company's actual profits come from selling printing supplies.

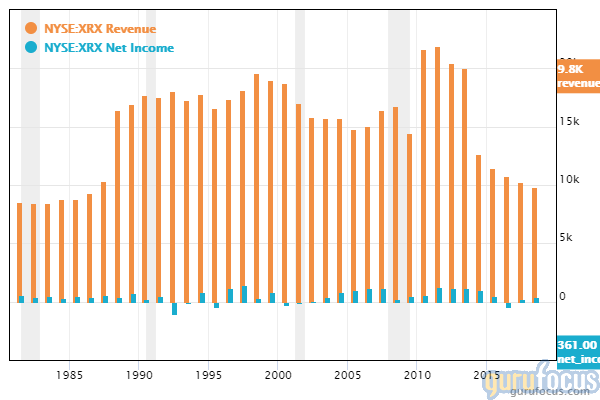

According to HP's earnings report, about one-third of its printing profits come from printer sales, while two-thirds come from the sale of printing supplies such as ink and paper. Xerox is in a similar situation; the company estimates it loses money for every printer it sells, while gleaning the vast majority of its profits from the sale of other printing supplies.

This puts both companies in a bit of a perilous position in terms of demand for their most profitable products. According to both companies' earnings reports, revenue from traditional printing and supplies has been declining in the low single digits at an average of 3% per year. Xerox and HP both have plans to enter the 3-D printing market with a focus on mass production, but these are mostly still in the incubation phase, with the exception of HP's Jet Fusion 5200.

The buy offer

Last week, Xerox made a combined cash and share offer to buy HP. Under the terms of the deal, Xerox would pay $17 in cash plus 0.137 of a Xerox share for each HP share, representing a 21% premium to HP's price before the offer was made. Xerox has already secured funding from Citigroup Inc. (NYSE:C) to finance the purchase. This would result in HP shareholders owning 48% of Xerox stock.

The bid comes as a bit of a surprise to shareholders, as HP's market cap of $29.08 billion is much larger than Xerox's market cap of $8.17 billion. Insiders of both companies see benefits in merging, estimating that combining the companies would allow them to shed approximately $2 billion in expenses, but they may face too many obstacles to a successful merger. HP representatives cited "potentially intractable disagreements" about which company should be the buyer and which the seller.

For one, HP opted not to offer to buy Xerox earlier this year, when the smaller company was basically on the auction block. Xerox's share price has increased since then, so HP is not likely to see the company as a better deal now. However, HP did offer Xerox a non-disclosure agreement in September, which is often a lead-up to due diligence, and Xerox refused. This may mean that HP wishes to buy Xerox after all, instead of the other way around.

The biggest issue facing the merger is who would make up the management team for the merged company. Although Xerox is making the bid, HP is the larger company, so this situation may end up in the whole idea being shelved due to power conflicts. Xerox is offering four weeks of due diligence for the companies to examine each other's books and decide if the $22 per share cash-and-stock offer, cost savings and research and development collaboration would be a good deal.

Potential benefits

On paper, Xerox has a cash-to-debt ratio of 0.19, a debt-to-equity ratio of 0.95, an Altman Z-score of 1.89 and a three-year revenue decline of 2.9%. With a price-earnings ratio of 13.1, the stock may seem like a good deal at first glance, but when you consider that the company's earnings keep declining while the stock price keeps ranging, this measure becomes worthless as a predictor of value.

Meanwhile, HP may have a three-year average revenue growth rate of 8.5%, but it also has a three-year average Ebitda decline of 17.7%. The company's total stockholders' equity for the second quarter of 2019 was a deficit of $1.13 billion, and this measure has been in the negatives for the company since the third quarter of 2016. Though its cash-to-debt ratio of 0.97 and Altman Z-score of 2.44 put it out of the immediate financial danger zone, a negative stockholders' equity means that if the company really were to go belly-up, investors would get nothing.

From a financial standpoint, you could say that both Xerox and HP desperately need a breath of fresh air. The new HP CEO, Enrique Lores, plans to cut 9,000 jobs (16% of its total workforce) over the next three years in order to cut costs by $1 billion. When you consider that the company's annual net income was $5.3 billion in 2018, $2.53 billion in 2017, $2.49 in 2016 and $4.55 billion in 2015, this move seems almost desperate. Merging with Xerox might allow similar cost cuts without the pain of lost productivity.

Xerox hopes that merging with HP will create a printing behemoth that will be able to improve its competitiveness against online printing supplies sellers by joining hands with its major in-stores competitor. However, investors worry that focusing too much on printing would damage the PC business for HP, especially if Xerox's management took the reigns after a merger.

Although printing currently brings in the majority of HP's net earnings, the PC business is actually growing while the printing business is declining. Investors worry that combining the old printing giants, who have already outlived their glory, would only make them keel over faster, taking HP's computers with them. This is unlikely to happen, however, unless the companies merge and subsequently decide to cut the price tags on their printing supplies, since even in its slow decline the printing business provides a steady stream of revenue without major fluctuations. Only major regulatory or technological changes could diminish sales quickly.

Looking forward

It will be interesting to see where the stock prices for Xerox and HP go over the next month as the companies consider the idea of merging. So far, representatives of both companies have declined to publicly comment on the matter.

Following Xerox's initial announcement of its bid, Xerox shares increased from $36.37 on Nov. 5 to $38.35 on Nov. 8 on optimism, showing that the general opinion is that the deal would not constitute an overpayment. The majority of the optimism seems to be due to projected savings, which would benefit shareholders regardless of which company acquires which. According to Bloomberg Intelligence analyst Robert Schiffman, "A merger with HP would create a behemoth printing and PC maker with nearly $70 billion in revenue. Though top-line growth challenges may remain in the intermediate term, synergies could help boost annual free cash toward $5 billion and enable future deleveraging."

All in all, shareholders and analysts seem to love the idea of a merger, while the companies involved have yet to announce anything concrete to the public. Both stocks have been bidding up since Xerox made its offer, so it seems likely that if the merger does not happen one way or another, we will see those prices crashing back down.

Disclaimer: Author owns no shares in any of the stocks mentioned.

Read more here:

Olstein Capital Management's Most Promising 3rd-Quarter Buys

Baron Funds Has High Expectations for Iridium Communications

Matthews Japan Fund Sells Fuso Chemical, Increases Stake in Nintendo

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.