The Xiangxing International Holding (HKG:1732) Share Price Is Up 31% And Shareholders Are Holding On

While Xiangxing International Holding Limited (HKG:1732) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 12% in the last quarter. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 31%.

Check out our latest analysis for Xiangxing International Holding

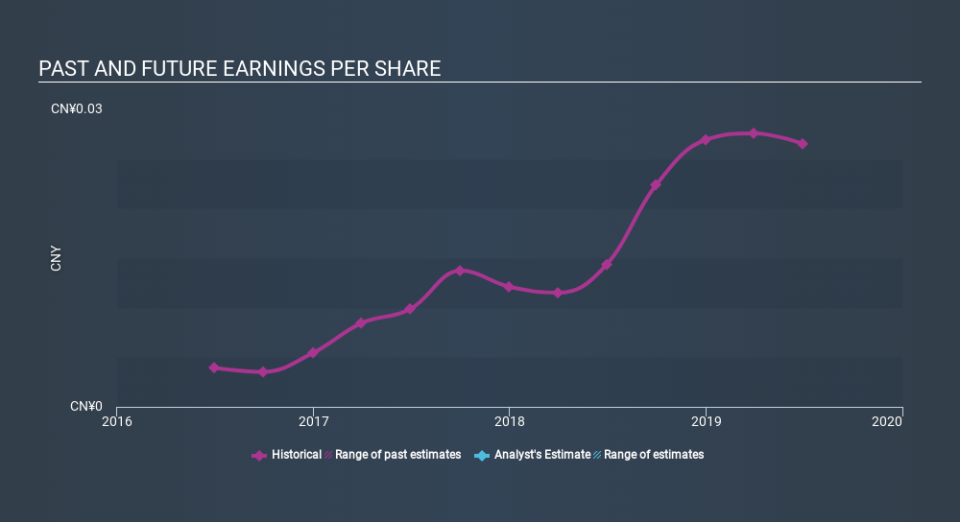

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Xiangxing International Holding grew its earnings per share (EPS) by 85%. It's fair to say that the share price gain of 31% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about Xiangxing International Holding as it was before. This could be an opportunity. This cautious sentiment is reflected in its (fairly low) P/E ratio of 8.81.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Xiangxing International Holding's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Xiangxing International Holding shareholders have gained 31% over the last year. Unfortunately the share price is down 12% over the last quarter. Shorter term share price moves often don't signify much about the business itself. If you would like to research Xiangxing International Holding in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Xiangxing International Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.