Is Xingda International Holdings (HKG:1899) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Xingda International Holdings Limited (HKG:1899) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Xingda International Holdings

What Is Xingda International Holdings's Debt?

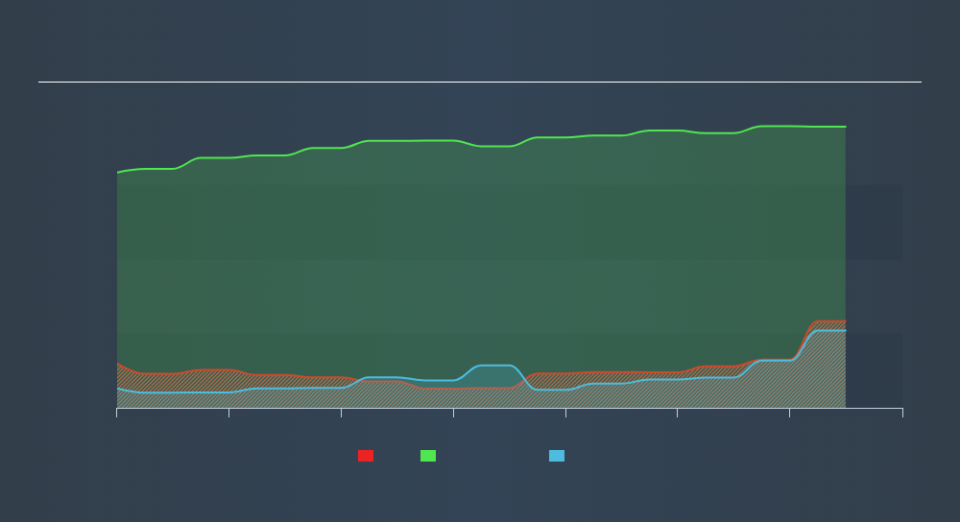

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Xingda International Holdings had CN¥2.32b of debt, an increase on CN¥1.11b, over one year. However, it does have CN¥2.07b in cash offsetting this, leading to net debt of about CN¥255.7m.

How Healthy Is Xingda International Holdings's Balance Sheet?

The latest balance sheet data shows that Xingda International Holdings had liabilities of CN¥5.78b due within a year, and liabilities of CN¥313.6m falling due after that. Offsetting this, it had CN¥2.07b in cash and CN¥4.73b in receivables that were due within 12 months. So it can boast CN¥701.2m more liquid assets than total liabilities.

It's good to see that Xingda International Holdings has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Xingda International Holdings has net debt of just 0.28 times EBITDA, suggesting it could ramp leverage without breaking a sweat. But the really cool thing is that it actually managed to receive more interest than it paid, over the last year. So there's no doubt this company can take on debt while staying cool as a cucumber. In addition to that, we're happy to report that Xingda International Holdings has boosted its EBIT by 42%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Xingda International Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Xingda International Holdings produced sturdy free cash flow equating to 67% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

The good news is that Xingda International Holdings's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its EBIT growth rate also supports that impression! It looks Xingda International Holdings has no trouble standing on its own two feet, and it has no reason to fear its lenders. To our minds it has a healthy happy balance sheet. We'd be very excited to see if Xingda International Holdings insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.