US Futures Edge Higher With Earnings; Yen Tumbles: Markets Wrap

(Bloomberg) -- Stocks rose, with the S&P 500 set to extend its rally for a second day, as companies including Jeep maker Stellantis NV and social media company Pinterest Inc. reported better-than-exected earnings.

Most Read from Bloomberg

Real Estate Industry Takes Fresh Hit With Verdict on Commissions

Israel Latest: Blinken Returning to Israel; Refugee Camp Hit

Israel Latest: Jordan Recalls Ambassador to Israel as a Protest

S&P 500 futures added 0.2% and Europe’s Stoxx 600 climbed 0.6%. Bonds climbed, with the yield on the 10-year note falling 8 basis points, after the US Treasury reduced its estimate for federal borrowing for the current quarter, citing stronger-than-expected revenue.

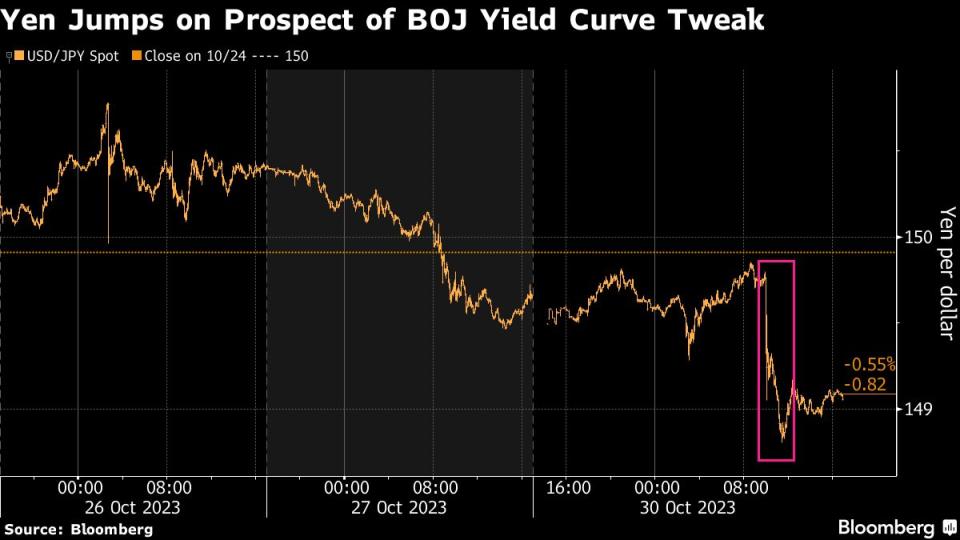

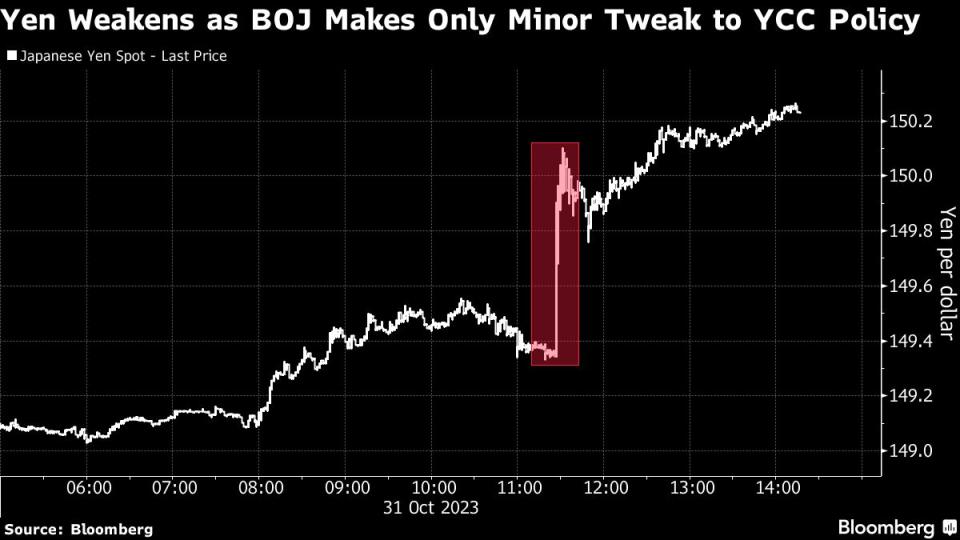

Some of the most dramatic moves in markets came from Japan after the central bank made only minor changes to its policy settings, disappointing some in the market who had expected more. The yen dropped back past 150 per dollar and slid to a 15-year low against the euro.

The BOJ’s shift is being closely watched by investors because of its tight control of the bond market since it introduced yield-curve control in 2016. The central bank said it will take a more flexible approach to controlling yields on 10-year government debt, marking a shift from a previous pledge to conduct daily bond buying operations at 1%.

“This is the first critical test of whether Japanese officials care about the speed of JPY depreciation or specific levels,” said Simon Harvey, head of fx analysis at Monex Europe. “Thankfully for them lower Treasury yields are delaying any urgency for an answer, but any unexpected hawkish comments from Chair Powell tomorrow or a larger issuance in longer-date Treasuries could force the issue as soon as tomorrow.”

Corporate Highlights:

Pinterest shares jumped as much as 17% in US premarket trading after the social-networking company reported third quarter results that beat expectations.

Stellantis gained 2.6% as it reported better-than-expected third-quarter revenue, bolstered by stable pricing, improving logistics and robust demand for models such as the electric Jeep Avenger.

Pfizer Inc.’s results missed expectations for the quarter as sales of its Covid-19 shot and Paxlovid pill continued to tumble

Caterpillar Inc. shares slid 4% in premarket trading after it reported a decline in its order backlog, even as it posted earnings that topped analysts’ estimates.

BP Plc shares fell 3.7% after third-quarter profit fell short of estimates.

Results from dating app firm Match and chipmaker Advanced Micro Devices are due after the close.

Elsewhere, oil prices rebounded after a steep drop yesterday as investors tracked developments in the Middle East. Israel struck more targets in Lebanon and Syria overnight, while stepping up its ground operations in Gaza. West Texas Intermediate rose to near $83 a barrel.

Key events this week:

Eurozone CPI, GDP, Tuesday

US Conference Board consumer confidence, employment cost index, Tuesday

China Caixin manufacturing PMI, Wednesday

UK S&P Global / CIPS UK Manufacturing PMI, Wednesday

US construction spending, ISM Manufacturing, job openings, light vehicle sales, Wednesday

All Saints holiday in much of Europe, Wednesday

Treasury quarterly refunding announcement, Wednesday

Federal Reserve interest rate decision. Fed Chair Jerome Powell holds news conference, Wednesday

Eurozone S&P Global Eurozone Manufacturing PMI, Thursday

Bank of England interest rate decision. Governor Andrew Bailey holds news conference, Thursday

US factory orders, initial jobless claims, productivity, Thursday

Apple earnings, Thursday

China Caixin services PMI, Friday

Eurozone unemployment, Friday

US unemployment, nonfarm payrolls, Friday

Canada employment report, Friday

Here are some of the main moves in markets:

Stocks

S&P 500 futures rose 0.3% as of 8:14 a.m. New York time

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 rose 0.7%

The MSCI World index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.4% to $1.0655

The British pound was little changed at $1.2180

The Japanese yen fell 1% to 150.66 per dollar

Cryptocurrencies

Bitcoin rose 0.2% to $34,510.75

Ether rose 0.6% to $1,812.02

Bonds

The yield on 10-year Treasuries declined nine basis points to 4.81%

Germany’s 10-year yield declined six basis points to 2.76%

Britain’s 10-year yield declined 10 basis points to 4.46%

Commodities

West Texas Intermediate crude rose 0.4% to $82.88 a barrel

Gold futures rose 0.1% to $2,008.50 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Matthew Burgess, Winnie Hsu, Zhu Lin and Tassia Sipahutar.

Most Read from Bloomberg Businessweek

Web Summit Israel Mess Is No Surprise to Those Who Know Its Founder

America’s Culture Wars Have Liberal Parents Opting for Home-Schooling

©2023 Bloomberg L.P.