This is how New York and New Jersey can restore the SALT deduction | Ciattarelli

Disagreement is one hallmark of a healthy political system, but bipartisan compromise should be another.

When the new Congress is sworn in next month, the first order of business for Republicans and Democrats alike in the New Jersey and New York congressional delegations should be — must be — to band together in solidarity to fully restore the state and local tax — SALT — deduction.

The Tax Cuts and Jobs Act of 2017, which was signed into law by former President Donald Trump, capped the SALT deduction, for no good reason, at $10,000. This had disproportionate effect on a few states, including New Jersey and New York. Reason being, the residents of both states pay the highest property taxes in the nation, as well as some of the highest state income taxes. The cap is all the more unacceptable considering the fact that our residents, including middle class families, send way more in federal taxes to the U.S. government than they receive back in federal benefits.

SALT redux:With GOP set to run House, could Congress restore big tax break for NJ homeowners?

Opposition to restoring the SALT deduction has certainly created, as we say in politics, strange bedfellows. Vermont’s Sen. Bernie Sanders, an Independent who caucuses with the Democrats and is chairman of the Senate Budget Committee, said the deduction is a “tax break for the rich.” Many congressional Democrats have said the same. Joining them in opposition is Nebraska’s Republican Rep. Adrian Smith, whose position is that the SALT deduction is a “subsidy” for liberal state policies.

Sanders and Smith have obviously never owned a home in New Jersey. The fact is plenty of middle class families across New Jersey are paying more than $10,000 in annual property taxes.

Sanders and Smith also seem ignorant as to what those property taxes pay for. It’s schools, local police and fire, public health, public works, infrastructure, open space, parks and recreation and senior citizen services.

Economically speaking, many New Jersey residents bought homes based on the net benefit of fully deducting property taxes on their federal tax returns. The sudden elimination of the full deduction in 2017 was terribly unfair to them, while making homes all the more expensive for everyone, including first-time homebuyers and minorities.

The most misleading and partisan rhetoric of all is the tired ‘us versus them’ argument that the SALT deduction is "a tax break for the rich." Considering what some New Jersey homeowners pay in property taxes, knowing what those taxes pay for, and realizing higher-end homes pay property taxes that lesser valued homes do not (e.g., affordable housing), isn’t the SALT deduction the right kind of tax fairness?

All this is not to say that permanent property tax reform isn’t desperately needed here in New Jersey. It is. Gov. Phil Murphy’s new rebate program — gimmick? — isn’t, and won’t ever be, the answer. Quite frankly, it’s insulting that New Jersey takes a whole lot of money out of your right-hand pocket, only to put a little back in your left-hand pocket and call it "tax relief."

How best to get the SALT deduction fully restored? In the U.S. House of Representatives, New Jersey has 12 members; New York has 26 members. That‘s 38 total members, plus, of course, four U.S. Senators. In a closely divided Congress, that’s a decisive bipartisan voting bloc that needs to be leveraged.

Many New Jersey and New York members of Congress ran for election promising to fully restore the SALT deduction. Come January, they can make good on that promise by withholding their support for all major legislation until congressional leaders commit to holding a fair vote on SALT. The delegations should then use their combined power to ensure full restoration.

This is not, nor should it be, a partisan issue. Working together across party lines, a reconstituted and unwavering SALT Caucus that includes every member of the New Jersey and New York congressional delegation can get this done. What better holiday gift to taxpayers?

Wishing all a wonderful holiday season filled with peace and joy and a very Happy New Year. Hopefully, it will be one that includes a fully restored SALT deduction.

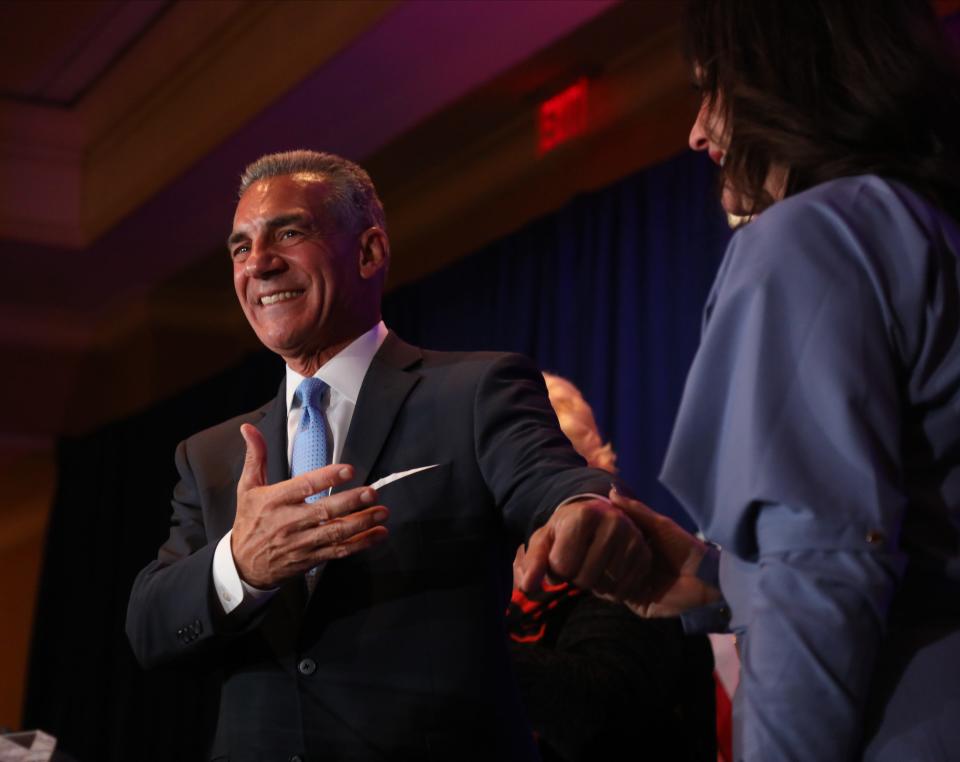

Jack Ciattarelli, the 2021 Republican nominee for New Jersey governor and a likely 2025 gubernatorial candidate, is a regular contributor to the opinion pages of USA TODAY Network New Jersey publications.

This article originally appeared on NorthJersey.com: New York and New Jersey can restore the SALT deduction. Here's how