New Zealand Budget Targets Families as Hipkins Eyes Election

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- New Zealand’s ruling Labour Party sought to ease the pain of spiraling prices for families in its annual budget, which comes less than five months out from a general election.

Most Read from Bloomberg

Singapore Air Hands Staff Eight Months’ Salary Bonus After Record Results

Here’s How Much Wealth You Need to Join the Richest 1% Globally

The government will boost subsidies for early childhood education and medical prescriptions, make public transport free for children and help lower household power bills by expanding its heating and insulation program, it said in the budget Thursday in Wellington.

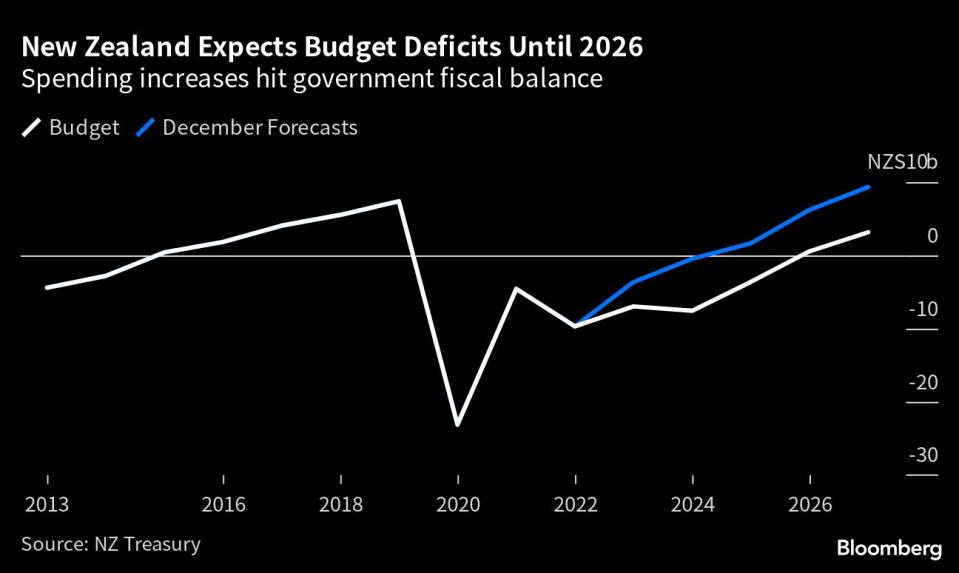

With the economy expected to slow and the costs of natural disasters weighing on its finances, the government will run six straight years of deficits in the wake of the pandemic, pushing the return to surplus out by a year to 2026, the budget shows.

Prime Minister Chris Hipkins needs to curtail spending to damp inflation but must also invest more in infrastructure and core social services such as education and health to convince voters to give Labour a third term in the Oct. 14 election.

Opinion polls shows Labour is currently neck-and-neck with the main opposition National Party, which is promising tax cuts.

“This package addresses the immediate cost-of-living challenge households face without exacerbating inflation pressures, as tax cuts would,” Hipkins said. “Global inflationary pressures coupled with the domestic challenges of recent weather events mean a balanced and targeted approach is being taken.”

Weather Disasters

National Party leader Christopher Luxon slammed what he called the “Blowout Budget” as a “spending spree creating a massive increase in deficits and debt climbing for years to come.”

The government has to fund the rebuild from severe flooding events and Cyclone Gabrielle earlier this year, and invest in measures to protect against future climate-related disasters. It will spend NZ$6 billion ($3.8 billion) on a National Resilience Plan.

The budget deficit is now seen widening to NZ$7.6 billion in the 2023-24 fiscal year. That compares with the Treasury Department’s prediction in December that the deficit would narrow to NZ$460 million.

Government bond issuance will increase by NZ$20 billion over four years — more than economists expected — while net debt will peak at 22% of gross domestic product in 2024.

The Treasury forecasts an economic slowdown but it no longer expects a recession, while the nation’s current account deficit is forecast to recede from a record 8.9% of GDP.

“The Treasury is now forecasting New Zealand will avoid recession as the rebuild from the flooding and cyclone events support activity, along with stronger tourism,” Finance Minister Grant Robertson said. Real government consumption would fall significantly by 2025, which “means the government is doing its bit to avoid adding to inflation pressures,” he said.

RBNZ Rates

Still, Treasury calculates the budget will provide an expansionary fiscal impulse in the 2023-24 year, and said it now expects the central bank to hold interest rates “higher for longer” over the forecast period.

The Reserve Bank will decide on interest rates again on May 24, with most economists predicting a 25 basis-point increase in the Official Cash Rate to 5.5%.

The fiscal forecasts are more expansionary than anticipated and the budget will add to inflation pressures in the short term, said Nathan Penny, senior economist at Westpac Banking Corp. in Auckland.

“The RBNZ will now likely be looking at a higher OCR peak than the 5.5% it had previously projected,” he said.

Westpac expects the cash rate to rise to 6% in August while ANZ Bank economists project it to peak at 5.75% in July.

Treasury expects the economy to expand 3.2% in the year through June before growth slows to 1% the following year. Inflation is seen declining below 3%, back within the RBNZ’s 1-3% target band, by the end of 2024.

Unemployment is expected to peak at 5.3% next year, while house prices will start to rise in the year through June 2025, Treasury’s forecasts show.

New Zealand is seeing a record inflow of migrants, which may alleviate worker shortages but also add to demand and potentially fan inflation.

Treasury said it expects net migration to peak at 65,000 in mid-2023 before falling to an average of 40,000 a year from 2024 onwards.

It assumes the demand boost from migration will slightly outweigh the supply boost, contributing to its view that unemployment will peak lower than previously predicted and that wage growth will be strong.

(Updates with economist comment in 15th paragraph)

Most Read from Bloomberg Businessweek

Sweetgreen Tests Robots to Make Faster, More Efficient Sad Desk Salads

Recession Calls Keep Getting Pushed Back, Giving Soft Landing Believers Hope

Peyton Manning’s Omaha Productions Becomes a Media Powerhouse

©2023 Bloomberg L.P.