Zooming in on TSE:CFX's 2.7% Dividend Yield

Dividend paying stocks like Canfor Pulp Products Inc. (TSE:CFX) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

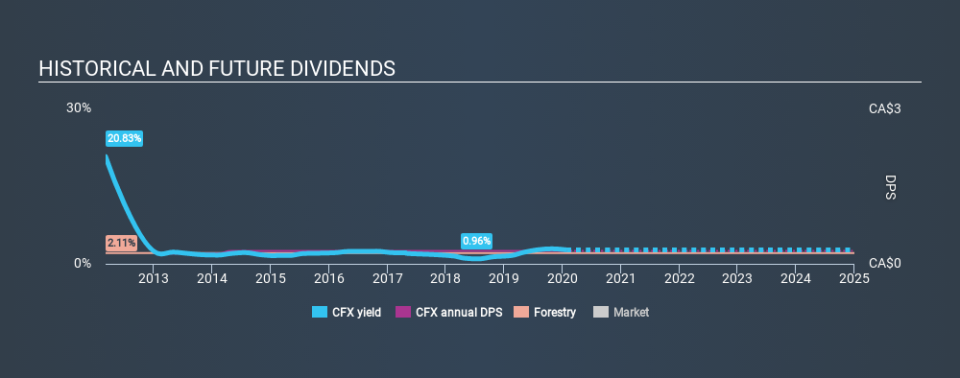

With a 2.7% yield and a eight-year payment history, investors probably think Canfor Pulp Products looks like a reliable dividend stock. A 2.7% yield is not inspiring, but the longer payment history has some appeal. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Canfor Pulp Products paid out 510% of its profit as dividends. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Unfortunately, while Canfor Pulp Products pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

Is Canfor Pulp Products's Balance Sheet Risky?

As Canfor Pulp Products's dividend was not well covered by earnings, we need to check its balance sheet for signs of financial distress. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. Canfor Pulp Products has net debt of 0.32 times its EBITDA, which we think is not too troublesome.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. Interest cover of 1.74 times its interest expense is starting to become a concern for Canfor Pulp Products, and be aware that lenders may place additional restrictions on the company as well.

Consider getting our latest analysis on Canfor Pulp Products's financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The first recorded dividend for Canfor Pulp Products, in the last decade, was eight years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past eight-year period, the first annual payment was CA$2.10 in 2012, compared to CA$0.25 last year. The dividend has fallen 88% over that period.

We struggle to make a case for buying Canfor Pulp Products for its dividend, given that payments have shrunk over the past eight years.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Canfor Pulp Products's earnings per share have shrunk at 39% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Canfor Pulp Products paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. In this analysis, Canfor Pulp Products doesn't shape up too well as a dividend stock. We'd find it hard to look past the flaws, and would not be inclined to think of it as a reliable dividend-payer.

Given that earnings are not growing, the dividend does not look nearly so attractive. See if the 4 analysts are forecasting a turnaround in our free collection of analyst estimates here.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.