The Lookout

The LookoutMost Republican 2012 candidates lack a plan to address a European meltdown

The biggest danger the American economy faces is the risk that the government of Greece or Italy could default on its debts--potentially triggering a meltdown in the eurozone, crippling the international banking system, and dragging down what little growth the economy is seeing right now.

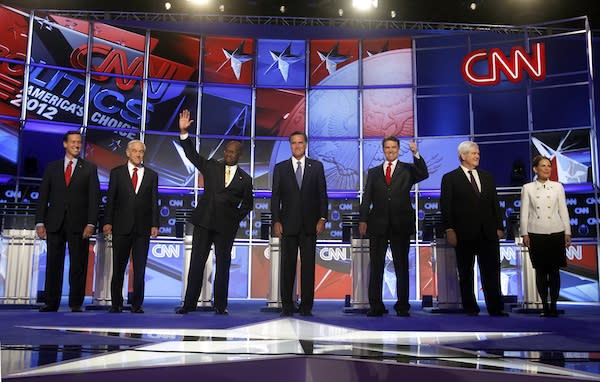

And yet, as the Republican presidential candidates prepare for their debate Wednesday night--this one devoted to economic issues--they have said almost nothing about what they propose doing to try to avert a European financial crisis, or to minimize its damage in the United States.

America's ability to control events in Europe is limited, but a U.S. president is hardly powerless on the issue. The White House didn't respond to a request for comment from Yahoo News about the administration's plans for dealing with a euro crisis. But at the G-20 meeting in Cannes, France, last week, President Obama prodded European leaders to implement measures that would protect other members of the euro zone--Italy and Spain in particular--from the impact of a Greek default. And he pressed the world's stronger economies to take steps to spur economic growth, in part to limit the turmoil in the event of a euro crisis. The administration could even end up rallying support at the International Monetary Fund for a wider bailout, if necessary--though congressional Republicans have sought, so far unsuccessfully, to block U.S. resources at the I.M.F. from being used for that purpose.

"The United States, obviously, has a great deal of influence, because of who we are and the role we play in the global economy," White House spokesman Jay Carney said last week.

But Mitt Romney, Rick Perry, Herman Cain and the rest of the field seeking the Republican presidential nomination have largely avoided the eurozone crisis. When they have addressed the subject, it has generally been to score political points by bashing government bailouts and over-spending, rather than to offer a clear guide to what they would do should the crisis worsen while they're in the Oval Office. And some candidates have appeared to badly misstate the nature of the problem.

Here's what each Republican candidate has, or hasn't, said--and what the record suggests about how each of them might handle a European meltdown as president.

Mitt Romney

What He's Said:

A one-time private-equity executive, Romney appears more willing than any of his rivals to act aggressively to keep the financial system afloat. Asked at a debate last month about a European meltdown that spreads to the United States, the former Massachusetts governor replied: "If you think the entire financial system is going to collapse, you take action to keep that from happening."

"In the case of Europe right now, they are looking at what's happening with Greece," Romney continued. "Are they going to default on their debt, are they not? That's a decision which I would I would like to have input on if I were president of the United States and try and prevent the kind of contagion that would affect the U.S. banking system and put us at risk."

He continued: "I'm not interested in bailing out individual institutions that have wealthy people that want to make sure that their shares are worth something," he said. "I am interested in making sure that we preserve our financial system, our currency, the banks across the entire country."

Referring to the 2008 Wall Street bailout, Romney added: "We were on the precipice, and we could have had a complete meltdown of our entire financial system, wiping out all the savings of the American people. So action had to be taken."

What That Means He Might Do:

Romney, whose campaign didn't respond to numerous requests for comment from Yahoo News, appears to be saying that as president, he'd work to reduce the chances of a default by Greece or another major European economy -- perhaps by pushing that country's government to accept a European rescue package, as President Obama has done lately with Greece. And if that failed, he's suggesting he'd move to to shore up the U.S. financial system and prevent a system-wide collapse -- using taxpayer dollars if necessary.

Rick Perry

What He's Said:

Perry has largely treated the issue as a useful segue into his standard plan to fix the economy. Asked last month by Neil Cavuto of Fox News what he'd do in the event of a Eurozone meltdown, the Texas governor said he'd "pull back all of these regulations that are killing our energy industry and get people to work in this country."

"The idea that America needs to be involved in the European issue from the standpoint of their sovereign debt is just foreign to me," Perry added. "I mean if you're too big to fail, you're too big."

The moral, Perry said, is that America should cut spending. "[Europeans] have got to learn the same hard lessons that we have to learn as a country," Perry warned. "It's that you can't keep spending money that you don't have and borrowing against the future. And that is the problem that America faces."

And he concluded: "[B]ailing out, whether it is somebody on Wall Street or whether it is a, a big company in America, it makes no more sense than bailing out the French."

What That Means He Might Do:

Perry's answer doesn't shed much light on the issue--in fact it confuses things further--and his campaign also didn't respond to several inquiries from Yahoo News. Few experts expect that the United States would need to bail out the French, and scrapping regulations on the energy industry would do nothing to address the problem under discussion: how to protect our own financial system--and potentially the broader economy--if Europe's banks stop lending, or fail outright. Perry appears to want to do as little as possible, but doesn't say how he'd respond if things reached the point where the U.S. financial system was on the verge of collapse.

Michele Bachmann

What She's Said:

In a recent interview with an Iowa radio station, the Minnesota congresswoman compared Greece to a petulant teenager, saying European leaders have "coddled" the Mediterranean country. "I certainly hope we're not trying to figure out how to bail out Greece," Bachmann said. "It's just like if you have a child who's a 16-year-old who's overspending their money and they crack up the car and they end having to go to jail. The worst thing you could do as a parent is go and bail that child out of their own irresponsible behavior."

Bachmann also slammed the Greek prime minister's short-lived plan to hold a referendum on whether to accept Europe's rescue package, which would require it to enact harsh austerity measures. "Now Greece is such a tantrum-throwing nation that they're going back to their own people with a vote so that the people can choose whether or not they want to have even an tiny level of austerity," she said. "Well, of course they don't. They want to keep spending money."

And, like Perry, she added that Greece's woes could offer a taste of what Americans are in store for if we don't cut spending.

What That Means She Might Do:

Bachmann -- whose campaign likewise ignored multiple requests for comment from Yahoo News -- doesn't offer anything like a specific course of action. She appears to say that Greece should approve the rescue package and endure the austerity conditions lenders are imposing. But as for what the United States should do if the turmoil spreads, she doesn't say.

Ron Paul

What He's Said:

Unlike some of his rivals, the Texas congressman seems to grasp how Europe's problems could impact the United States. "We're very much involved, because our banks are involved with derivatives, protecting the banks of Europe," he told Cavuto Saturday, after calling in to his radio show. "So that's why they don't want the banks to go under."

Asked by Cavuto whether, as president, he would bail out Greece or Italy -- a task most analysts expect would be left to Europe, perhaps with Chinese help -- Paul said no. But he added that he expected the Federal Reserve to do so. "There will be a lot of threats and intimidations and fear, just like they did in '08, and they will resort to bailing out," he warned.

What That Means He Might Do:

Paul, too, hasn't offered a clear plan for what he'd do in the event of a crisis, and his campaign didn't respond to several requests for comment from Yahoo News. His limited government principles suggest he'd try to keep the United States as removed as possible from foreign financial entanglements. But given the interdependence of today's global financial order, that's a long-term project.

Newt Gingrich

What He's Said:

The former House Speaker is certainly aware of the problem. In a speech this summer, he warned that the failure of Greece's economy threatens "a domino effect across southern Europe." And Gingrich raised the topic unbidden in a debate last month. "There's a real possibility that you can't have the euro and the Greek economy in the same system," he said. "There's a possibility we could have a meltdown in the next year."

Gingrich continued: "One of the reasons I've said that the Congress should insist that every decision document from 2008, 2009 and 2010 at the Fed be released is we are not any better prepared today for a crisis of that scale because the people who were in that crisis and were wrong are still in charge. And I think we need to learn, what did they do right and what did they do wrong, precisely for the reason you raised about 2013."

What That He Means He Might Do:

Again, Gingrich doesn't say what course of action he'd take, and his campaign didn't respond to several requests for comment from Yahoo News. But he wants the Fed's records from the 2008 financial crisis and its aftermath made public, so that they can help inform policymakers.

Jon Huntsman

What He's Said:

In a statement to Yahoo News, Huntsman spokesman Tim Miller said the former Utah governor would "lead by example by undertaking needed structural reforms at home to avoid what we are now seeing play out in Europe."

"Today if US banks started seeing funding issues Washington's plan is to undertake a second round of bailouts," Miller continued. "Governor Huntsman is the only candidate who has outlined steps which would avoid another round of bailouts by increasing our financial resilience by ending 'Too Big To Fail.' Capitalism without failure isn't capitalism."

Miller added that Huntsman wants to cut spending to reduce the deficit.

What That Means He Might Do:

Again, it's unclear, because Miller's statement misstates the problem, and he didn't respond to requests for clarification. The immediate concern is less that America's debt will lead it to default as Greece may soon do. It's that a European crisis could lead American banks to stop lending and American employers to cut back even further on hiring, causing another hit to the still-weak economy.

Herman Cain

We couldn't find any examples of Cain addressing the euro crisis, and his campaign -- perhaps distracted by other issues -- didn't respond to several requests for comment from Yahoo News.

Rick Santorum

Like Bachmann, the former Pennsylvania senator appears to have brought up the issue only to use it as an argument for why the United States should cut spending. He told Neil Cavuto in June that the U.S. debt problem is "worse than Greece." Santorum's campaign didn't respond to several requests for comment from Yahoo News.

Want more of our best national affairs stories? Visit The Lookout or connect with us on Facebook and follow us on Twitter.

Other popular Yahoo! News stories:

• Zoo separates 'gay' penguins so they'll mate with females

• Herman Cain discusses Sharon Bialek: 'I don't even know who this lady is'

• Paper calls for departures of Penn State president and Joe Paterno