The Ticket

The TicketMitt Romney’s not the only 15 percenter: John Kerry paid 13 percent in taxes in 2003

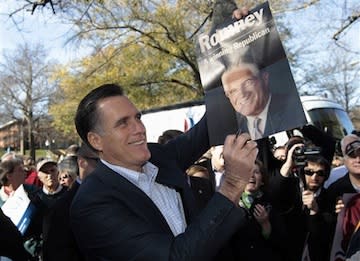

Mitt Romney acknowledged yesterday that his tax rate is probably about 15 percent--lower than what many high-income families pay. Romney, whose net worth is estimated to be between $200 and $250 million, pays a lower tax rate because most of his income comes from investments instead of a salary.

Romney's less-wealthy rivals for the 2012 Republican presidential nomination certainly pay higher tax rates than he does. Newt Gingrich said Wednesday that he paid about 31 percent of his income after deductions in taxes in 2010 and will release his returns this week. Rick Perry's tax returns showed he paid about 23 percent of his income in taxes.

Romney did not specify if 15 percent is his total tax burden or just his marginal income tax rate. Your effective tax rate is usually defined as the percentage of your total taxable income that you pay in federal taxes.

How does Romney's effective tax rate compare to the recent presidential nominees from the major parties?

In 2004, John Kerry and his wife released portions of their separate tax returns that showed the couple paid an effective federal tax rate of about 13 percent on $5.5 million in income from the year before. (At first, Kerry only released his own tax return. He later released the first two pages of the tax return of his millionaire wife, Teresa Heinz.) Some conservatives, like Stephen Moore of the Club for Growth, used Kerry's effective tax rate to criticize him for his opposition to a flat tax that would raise his taxes.

George and Laura Bush paid about 28 percent of their income in taxes in 2003, though their yearly income was a tenth of the Kerrys' that same year.

Vice President Dick Cheney, meanwhile, paid only 20 percent of his $1.3 million income in taxes in 2003.

In 2008, John McCain at first only released his own tax records, which showed he paid about 32 percent in taxes on his adjusted gross income of more than $400,000 a year. His far wealthier wife, Cindy, eventually made public the first two pages of her 2006 and 2007 returns, as Teresa Heinz did four years earlier. The 2007 return showed that she paid a rate of about 26 percent on more than $4 million in investments and salary.

The Obamas, newly wealthy from the sales of "Dreams of my Father," paid a rate of 35 percent in 2007 on $4 million in income. In 2010, the Obamas' effective tax rate was 26 percent, spokesman Jay Carney said this week.

Other popular Yahoo! News stories:

• Romney likens Gingrich to Al Gore as he sharpens his attacks in South Carolina

• No joke: Stephen Colbert ahead of Gary Johnson in national poll

• Gingrich bearing the brunt of negative TV ads in South Carolina

Want more of our best political stories? Visit The Ticket or connect with us on Facebook, follow us on Twitter, or add us on Tumblr.

Handy with a camera? Join our Election 2012 Flickr group to submit your photos of the campaign in action.