Augusta mails property reassessments, appeal deadline March 18

AUGUSTA COUNTY – The 2024 Augusta County property assessments are online for anyone and everyone that might need them.

The assessments were mailed to property owners on Feb. 20, according to a press release from the county. The new assessments are also available online at www.AugustaCountyVA.gov/RealEstateDatabase. If the mailed copy does not arrive before March 6, the release recommends using the online tool or reach out to Commissioner of the Revenue’s office.

Last year's tax rate was 63 cents for every $100 of assessed value. This is the value included on the assessment form, but the 2024 tax rate has not been set yet. The News Leader recently looked into the assessment and the upcoming tax rate decision. If the assessments are higher and the tax rate remains the same, the property owner would pay more in taxes than they did last year. However, the Augusta County Board of Supervisors would have to approve such an increase in collected revenue, even if the tax rate does not change, before it goes into effect.

The News Leader's reporting suggested the upcoming assessments would be significantly higher than the previous 2019 assessment. The press release does not give an average increased value, but it does address an increase.

“Augusta County is not alone in seeing a jump in home valuation," reads the press release. "At the end of January, home prices nationally were up 45% since March 2020, the early days of the pandemic. Higher home prices reflect higher demand with a continuing limited supply of homes on the market.”

"The deadline for completion of the reassessment book is not until March 31," Augusta County Communications Manager Mia Kivlighan told The News Leader. "Once the book has been finalized, we can determine averages."

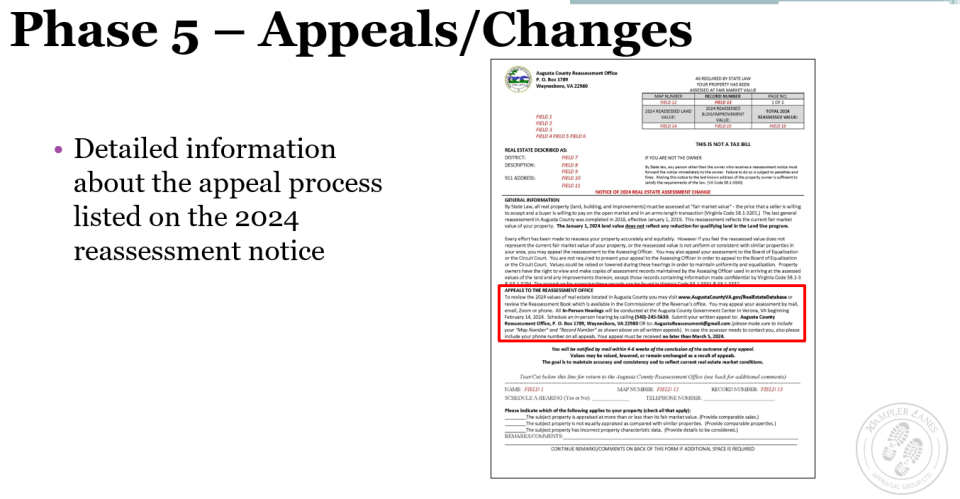

The assessment can also be appealed informally in person, by mail, email, Zoom, or phone call. The easiest method is to use this link to appeal directly on Augusta County’s website. The deadline to appeal is March 18, even if the initial mailed assessment doesn’t arrive. Other directions are also provided on the assessment form.

The press release also provides resources for tax relief, such as Augusta County’s program for disabled or elderly residents, another for veterans with 100% service-connected, total and permanent disability, and a land use deferment, providing the program meets agriculture, horticulture, or forest requirements.

Lyra Bordelon (she/her) is the public transparency and justice reporter at The News Leader. Do you have a story tip or feedback? It’s welcome through email to lbordelon@gannett.com. Subscribe to us at newsleader.com.

More: A club team just 3 years ago, Staunton's Mary Baldwin is now the top seed in the USA South

More: Girl Scout Cookies: Where can you buy Thin Mints, Samoas, Tagalongs and Do-si-dos?

This article originally appeared on Staunton News Leader: Augusta mails property reassessments, appeal deadline March 18