Lawmakers hope to address child care crisis with three-pronged tax credit package

Accessing child care has been a struggle for many parents in Missouri, keeping some from fully pursuing their chosen careers.

Lawmakers hope to alleviate those strains with a bill that would create three new tax credits aimed at boosting access to child care.

Legislation sponsored by Rep. Brenda Shields, R-St. Joseph, passed in the Missouri House on Thursday, with a vote of 113-39. Although many Republicans supported the measure, all of the votes against the bill came from GOP legislators.

“For Missouri's economy to prosper, it requires an educated, trained and reliable workforce, but 28% of our parents have said that they have missed work for the lack of childcare,” Shields said.

Missouri lost an estimated $1.35 billion last year because there were not enough workers to fill positions in the economy, according to a study by the U.S. Chamber of Commerce Foundation.

“Over 60% of our businesses said that they have trouble with retaining and recruiting employees to work in their business,” Shields said. “This is our first step. It might not fix it all, but we'll go from there.”

Additionally, Shields testified that there is only one available opening for every three children needing child care in the state.

Shields’ legislation takes a three-pronged approach to solving the problem, with three distinct tax credits aimed to boost child care. As currently written, the tax credits would expire at the end of 2030.

Child Care Contribution Tax Credit: Donors to child care providers are eligible to receive tax credits of up to 75% of their qualifying donation, up to $200,000. These tax credits must be used to “promote child care” by the provider.

Employer Provided Child Care Assistance: Businesses with two or more employees who provide assistance paying for child care can receive tax credits of up to 30% of those contributions, up to $200,000.

Child Care Providers Tax Credit: This specifically helps child care providers with three or more employees by allowing them to claim tax credits equal to their eligible employer withholding tax. There is also a tax credit of up to 30% of the provider’s eligible capital expenditures.

The National Federation of Independent Business, a small business-focused industry group, supports implementing Shield’s legislation, with NFIB State Director Brad Jones acknowledging the impact of the child care shortage on small businesses.

“Roughly 40% of small businesses have an open position that they cannot fill,” Jones said. “Increasing access to affordable child care is a huge piece of the workforce puzzle.”

House Minority Leader Crystal Quade spoke to the far-reaching effects of the child care crisis. She specifically mentioned areas with four-day school weeks, where parents are often scrambling to find child care on the fifth day of the week, when they still have to work but their child is not in school.

“This is a problem that we know is crossing all spectrums,” Quade said. “It's not just in rural places or urban places. This is truly every corner of the state of Missouri.”

More: Early in session, lawmakers set sights on addressing child care crisis in Missouri

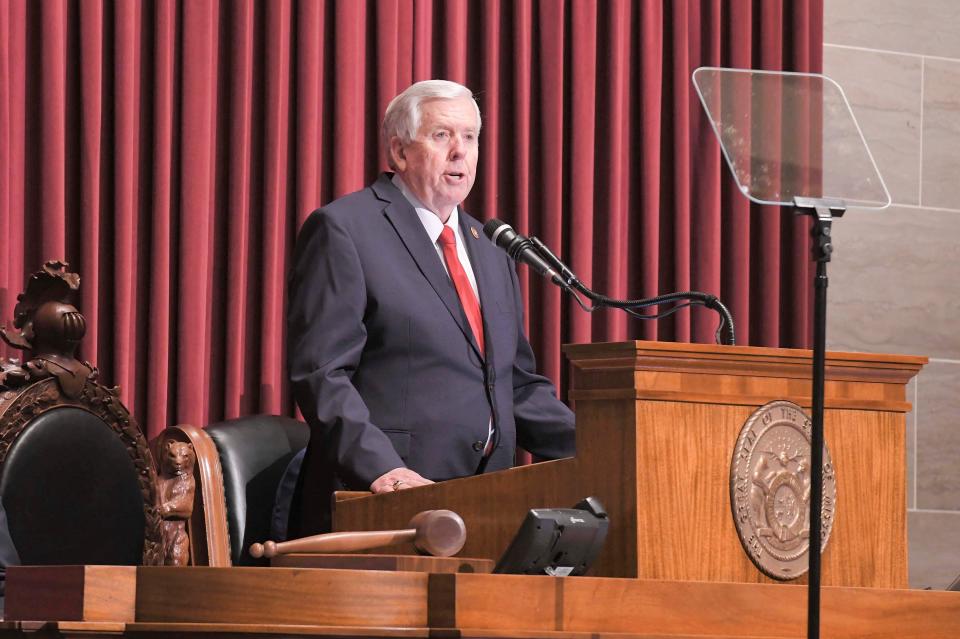

In his State of the State address, Gov. Mike Parson specifically mentioned the child care legislation as something he hopes to see passed. He has proposed making a $52 million investment in a state child care subsidy program.

“Today, we have the capacity to serve just 39% of Missouri children in licensed facilities,” Parson said in his speech. “It’s time for change.”

The legislation now goes to the Missouri Senate, where some Republican members have already voiced opposition to creating another government funded program.

“This idea of creating more government subsidies and another government program as a way to solve problems, I think its just the latest in a misguided attempt by the minority to try to install government in every aspect of our lives,” said state. Sen. Bill Eigel.

State Sen. Lauren Arthur, who has sponsored identical legislation in the Missouri Senate, hopes to see some consensus among members on addressing the issue.

“My hope is that people will put politics aside and finally do something to (help) the many, many families that are having a hard time affording childcare,” Arthur said.

This article originally appeared on Springfield News-Leader: Plan to create child care tax credits passes the Missouri House