NJ faces significant deficits. We have to spur investments and cut state spending

- Oops!Something went wrong.Please try again later.

Opinion pieces on the New Jersey state budget don’t always make for the most interesting reading. Far too often, these columns are terribly dense, written mostly by and for policy wonks.

When it comes to the state budget, all New Jerseyans really care about is, “What does it mean to me and my wallet?” Knowing that Gov. Phil Murphy’s seventh budget will be made public in the coming days, the answer to that question is, “The news isn’t good.”

For sure, the governor will put a positive spin on things. Unspent federal COVID-19 relief funds, unexpected pandemic tax revenues and unnecessary pandemic borrowing give him a significant surplus to pretty things up, which brings to mind the old saying of what you get when you put "lipstick on a pig."

Significant deficits loom

The fact is, looking forward, there are significant budget deficits as far as the eye can see.

Given that state spending is up more than $18 billion — 54%! — during Murphy’s first six years in office, the anticipated deficits are extraordinary. Why? Because no governor has had a better opportunity to truly reform New Jersey and because anyone and everyone taking a mid- to long-term view of our fiscal position knew what was on the horizon.

Sadly, the opportunity to enact reforms that address what’s driving New Jersey’s budget deficits is once again being wasted away. Instead, the governor and Democratic-controlled Legislature are kicking the can down the road in supporting tax increases and higher tolls and transit fares to balance their budget.

The kind of deficits we’re talking about are structural, which can sometimes be covered up, but never truly fixed by a good or great economy. Said another way, structural deficits are continual, worsening year after year after year.

What’s driving these structural deficits are:

Taxes that make New Jersey unfair, unaffordable and regionally non-competitive;

An unfair school funding formula that drives up property taxes while failing students;

Public pensions;

Medicaid expenditures; and

Skyrocketing spending, which has been turbo-charged during Murphy’s tenure.

Jack Ciattarelli: Gov. Phil Murphy missed another opportunity to press for relief on NJ property tax burden

What can be done? NJ needs a fairer tax system

There are only two ways to erase structural deficits: tax reforms and spending cuts.

A good start to making New Jersey more affordable for both individuals and businesses would be along the lines of what Pennsylvania has done. For individuals, that means a simpler tax structure, eliminating the transfer inheritance tax, and never taxing retirement income. For businesses, that means cutting taxes, which would make New Jersey much more regionally attractive and, in turn, create more jobs.

As for school funding, we need a new formula for distributing state aid. A new formula would ensure that similarly assessed homes pay approximately the same in school property taxes and that educational costs per student across the state are all within a reasonable range. Talk about equity!

As for public pensions, first and foremost, anyone who has earned a pension will receive that pension, period. That shouldn’t mean, however, that other pension alternatives, including those that provide increased ownership and flexibility for recipients, shouldn’t be explored, especially for new hires.

While Medicaid is a federal program, the state is responsible for paying one-half its cost. Given the ever-increasing levels of poverty in New Jersey, Medicaid expenditures are growing exponentially. Forever committed to improving access to and quality of health care, we need to reform the way Medicaid medical services are provided and paid for. Also, in addressing poverty head-on by providing better educational and economic opportunities, we can decrease the number of people on Medicaid.

As for spending, the governor and Democratic-controlled Legislature just can’t help themselves as they spend us into fiscal crisis. Case in point, state spending increased 54% over the past six years while personal income in New Jersey rose only 24%. Last year alone, the budget included $1.5 billion in pet projects or pork spending. Given the recent toll and NJ Transit fare increases, are a $58 million state subsidy for a Jersey City French art museum and $40 million to provide $15,000 grants to home buyers critical priorities?

To put it bluntly, our state’s budgetary position today is the equivalent of fiscal malfeasance, not to mention a searing indictment of the executive and legislative branches.

Reforms that spur more business investment and create more jobs and significant spending cuts are the only way to avoid massive tax increases on individuals and businesses. We did it during the Great Recession. We can do it again.

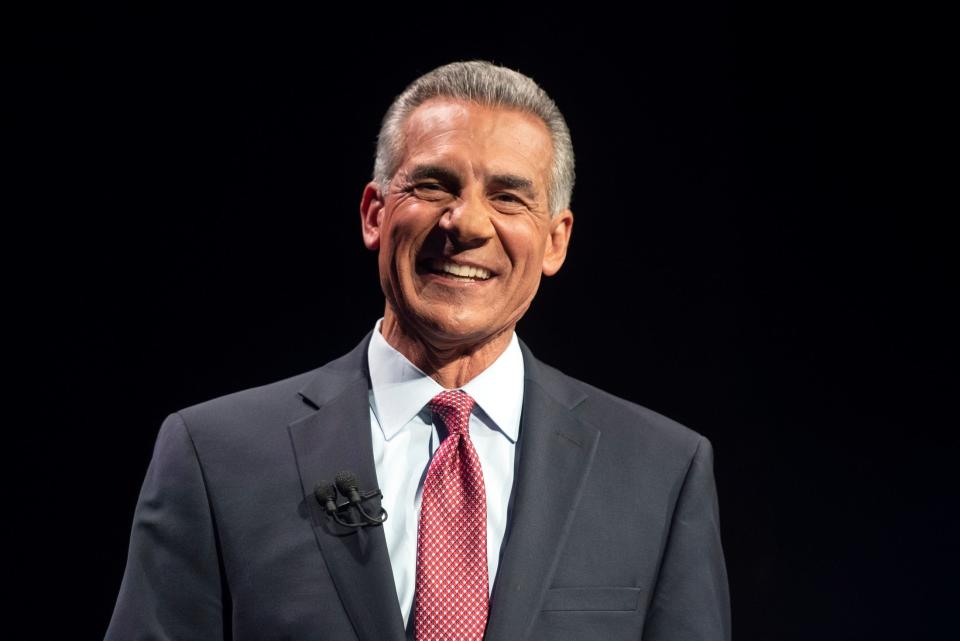

Jack Ciattarelli, the 2021 Republican nominee for New Jersey governor and a likely 2025 gubernatorial candidate, is a regular contributor to the opinion pages of USA TODAY Network New Jersey publications.

This article originally appeared on NorthJersey.com: NJ budget 2024: Murphy is on the wrong track