6 big takeaways from McKee's $13.7B budget proposal – from bonds to cigarettes to Cliff Walk

- Oops!Something went wrong.Please try again later.

PROVIDENCE - Rhode Island would build a new museum for its archives, give thousands of retirees a tax cut and raise the cost of smoking and vaping under a $13.7-billion state budget proposed by Gov. Dan McKee on Thursday.

The tax and spending plan for the year starting July 1 asks voters to approve $345 million in borrowing to pay for several big construction projects, including the archives, new buildings at the state's public colleges and repairs to Newport's famed Cliff Walk.

It does not include any broad-based tax increases, nor does it include a high-profile tax cut, like the sales tax reduction McKee proposed a year ago before it was jettisoned by state lawmakers.

After breaching the $14-billion mark for the first time this year, McKee's budget for next year would have total spending decline slightly – by around $330 million – as federal pandemic aid ebbs away.

But the decrease in spending is probably smaller than many people expected given how rapidly the budget was inflated – from $9.4 billion in fiscal 2018-2019 – by federal emergency COVID funds.

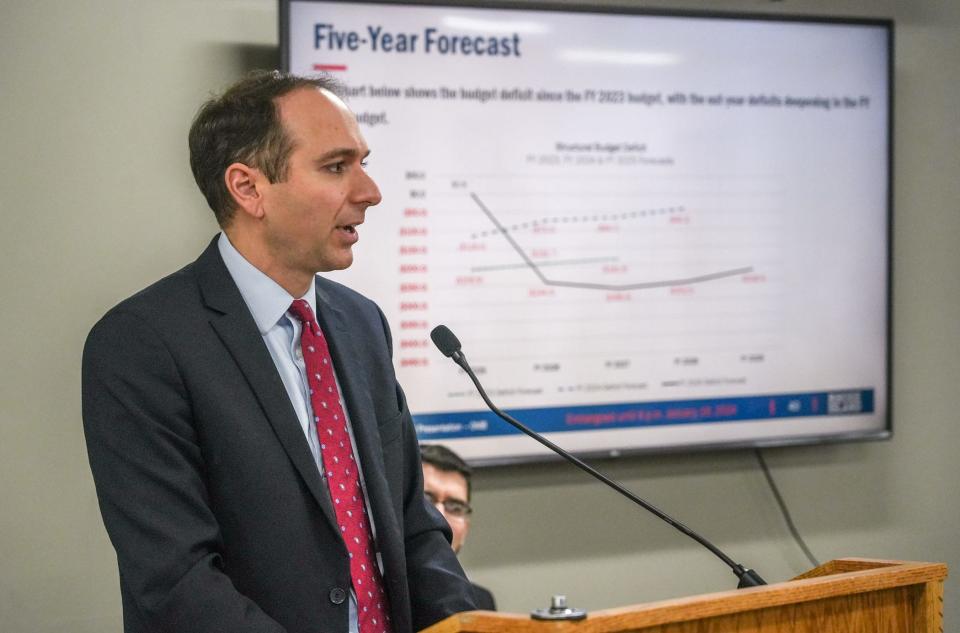

"We are not facing a recession," Brian Daniels, director of the Office of Management and Budget told reporters Thursday about the dynamics shaping the budget. He noted that analysts "see revenue growth" ahead without any emergency adjustments.

"While not as robust as it was in prior years, it is still positive," he said about revenue growth. "This shows a fiscally responsible approach is paying off."

More: What's in McKee's $13.7B budget proposal? Here's the numbers at a glance.

Here's what you need to know:

The 4 things you'll vote on in November

As expected, McKee is using the upcoming November general election to make the customary every-other-year request for new state voter-approved borrowing.

In this case, there will be four separate bond referendums for college buildings, housing production, the state archives museum and an assortment of "green" branded improvements.

The $135-million higher education bond would provide $80 million to construct a biomedical sciences building at the University of Rhode Island and $55 million for a cybersecurity building at Rhode Island College.

The $100-million housing bond would provide another injection of capital into the state's housing-affordability programs. No breakdown of the specific uses for the money was immediately available, but McKee has said he wants it to emphasize help with homeownership as well as construction.

The $60-million state archives bond, championed by Secretary of State Gregg Amore, would pay part of the cost to build a dedicated home and museum for state archives that have been shuttling between rented spaces for years. The archive building has been estimated to cost around $100 million.

The $50-million "green" bond would send $20 million to the Port of Davisville (Quonset) for oversize freight vehicle roads, $10 million for "municipal resiliency" against flooding, $8 million to fix Cliff Walk, $5 million for brownfields, $5 million for local recreation and $2 million for "climate resiliency." The Cliff Walk was damaged by storms in 2022 and Newport has been looking for $10 million to fix it.

Some retirees, businesses and heirs would gain

For the second time in three years, McKee seeks to cut taxes on retirement income. The budget would raise the personal income tax exemption for income from sources such as pensions, 401ks and annuities from $20,000 to $50,000 starting in tax year 2025.

The larger exemption would apply only to retirees below certain income thresholds, estimated at $105,950 for single filers and $132,450 for couples in 2025. That's expected to reduce the tax bills of around 10,000 Rhode Islanders, with an average savings of about $500 per taxpayer. The state is expected to give up $4.7 million per year with the tax cut.

For businesses, McKee wants to cut the corporate minimum tax from $400 to $350, benefitting 65,000 corporate entities. The cut is estimated to cost the state $6.1 million per year.

Heirs would save $50 on their inheritances under McKee's budget proposal to cancel a $50 fee charged to estates when they are passed on. The estate tax is paid on inheritances of $1.77 million and larger. The elimination of the fee would cost the state $230,000 in a full year.

Smokers and vapers would pay more

McKee wants to hike the tax on each pack of cigarettes by a quarter, from $4.25 to $4.50.

At the same time, he wants to subject all e-cigarettes or "electronic nicotine delivery systems" to the state's 80% wholesale tax on tobacco products, raising the cost to vape. Taxing these vaping products is expected to generate $5.3 million per year.

Red ink for RIPTA

Bus riders and mass transit advocates were hoping for more than the $10-million one-time injection of federal funding McKee's budget would provide the Rhode Island Public Transit Authority to address a looming "fiscal cliff."

RIPTA is facing an $18-million budget gap for next year and larger expected deficits in the years after that.

Daniels said because RIPTA's expenses have risen while ridership has declined, McKee is ordering the agency to perform an efficiency study to see how it can cut costs.

He said he did not know whether RIPTA will have to cut service or lay off workers, because the $10 million is short of the projected deficit.

There is not money in McKee's budget to fund the RIPTA Transit Master Plan.

Medicaid

With the state facing a multi-front health care crisis, McKee is proposing a whopping $135-million boost in Medicaid payments that will help some service providers but not others, including the primary care doctors Rhode Island is losing at a rapid pace.

Medicaid is already the largest single line item in the state budget. Around 350,000 Rhode Islanders, a third of the population, are insured through the state's Medicaid program.

McKee wants lawmakers to boost the Medicaid reimbursement rates paid certain providers, such as those who provide mental health, substance abuse and home health care services, by $51.7 million and fill gaps in required early-intervention services for young children with developmental delays ($3.8 million).

He wants to steer another $79.7 million into what is being described as a new "Certified Community Behavioral Health Clinics model" to provide a "de-institutionalized, comprehensive range of behavioral health, medical screening and monitoring, and social services to particularly vulnerable populations with complex needs."

Asked why the administration is not seeking to boost the Medicaid reimbursement rates for primary care doctors and clinicians before the severe shortage grows, Richard Charest, the state's secretary of health and human services, told The Journal: the state's insurance commissioner "will be contemplating and evaluating primary care reimbursement rates. That hasn't been done yet."

Other notable items in the budget

$7.4 million for the ongoing rehabilitation of the Cranston Street Armory

$1.4 million for tourism marketing in cities with flights from Rhode Island T.F. Green International Airport

$500,000 for electric bicycle rebates

$25,000 to advertise public shoreline access points

$5 million for municipal road repairs

$234.7 million to reimburse cities and towns for no longer having a car tax

This article originally appeared on The Providence Journal: McKee's $13.7B RI budget: Six takeaways, including higher cigarette tax