'You’ve got to be vigilant': Identity theft happens weekly in Monroe

FRENCHTOWN TWP — At least once a week, Aaron Kipfmiller sees identity theft in Monroe County.

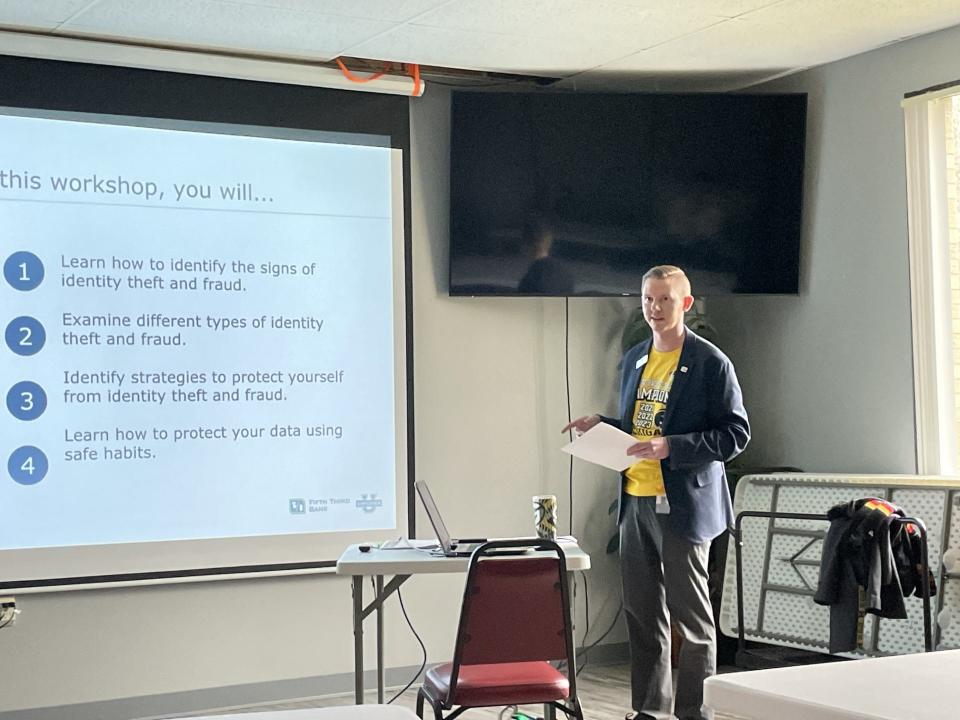

Kipfmiller is a personal banker at Fifth Third Bank’s location at Telegraph and Mall roads. On Monday, he spoke at Frenchtown Center for Active Adults about identity theft. He said prevention is key, because it’s often difficult to get stolen money back.

“People have had to request government assistance or borrow money. I’ve had people take loans out,” Kipfmiller said.

“Identity theft” is obtaining someone's personal information. “Identity fraud” is actively using that information to steal something of value. Both are big problems.

“There is a ton of it out there. It’s a major problem,” said Kipfmiller, who’s been at the bank for six years. “I’ve seen more fraud the previous year than in the other five years combined. There is a theft (somewhere) every two seconds.”

Anyone can be a victim.

“You’ve got to be vigilant. People don’t think it can happen to them. It’s targeted more toward the elderly, but I’ve seen people in their 20s and 30s fall for it,” Kipfmiller said.

While most know about the common type of identity theft, such as stealing biographical or financial data, like credit card and bank account numbers, Kipfmiller said there are a couple of lesser-known types of identity theft.

Medical data theft is using another’s identity to get prescriptions or medical treatment.

“This doesn’t get talked about a lot. If they have your medical data, it can mess you up when you get medical treatment. (Pharmacies) may say, we already filled this prescription,” he said.

Biometric data theft involves fingerprints, face recognition and eye scans.

“It’s more technical, FBI stuff,” Kipfmiller said. “Anything that is connected to you is what they’re looking for.”

Identities can be stolen through several means, such as digging through trash, looking over a person’s shoulders, stealing mail or skimming.

“Most think it’s online, but it’s not all online. If you’re at an ATM, make sure there is not someone right behind you looking for your PIN number,” Kipfmiller said.

He’s seen a recent decline in skimming, or the processing of putting a machine on an ATM or gas station credit card machine to read accounts and send numbers to a scammer.

“There is not as much as it used to be, but we still hear about them from time to time,” Kipfmiller said. “We have someone at the bank who checks the ATM for skimming devices. You don’t see a big giant box, but if you’re looking for it, you can see it. Credit and debit cards now are more sophisticated and randomize numbers. It’s unique every single time; the number doesn’t work the second time.”

An audience member asked if tapping credit cards is safer than swiping or inserting.

“Tapping is the safest. That depends on the institution (if it's offered). Fifth Third taps for all credit and debit cards,” Kipfmiller said.

He also discussed today’s common scams.

Phishing scams are emails or texts that appear to be from a legitimate source, like a bank, but are actually from scammers. Typically the messages have a sense of urgency and often contain misspellings. Kipfmiller said instead of clicking on a link in the message, people should look up the bank or organization’s number and call it.

“As soon as you start clicking a link, you’re going down a rabbit hole,” he said. “Hang up and call the financial institution yourself. That way you know who you’re talking to.”

Wire fraud is a common scam that asks people to send money, perhaps because a family member is in jail or a hospital. These also usually have a sense of urgency.

“That’s an old one. I heard that a long time ago,” a woman in the audience said.

“It still happens,” Kifpmiller said. “People do fall for it. Customers who fell for it say they can’t believe they did. Take a step back. Before you start sending money, make a phone call. Ask, ‘what jail, I’ll call that jail.’ That thing is blown up then. Stopping, pausing and thinking is really the key.”

Phone scams remain common. Kipfmiller suggests not answering an unknown call. A legitimate caller will leave a message.

“Scams comes in spurts. They’ll be a lull and then go back up with whatever the new scam is,” he said.

Kipfmiller also sees elder fraud scams.

Previous Coverage: Monroe County Sheriff Troy Goodnough addresses phone scams with seniors

“Seniors walk into the bank with someone younger that we’ve never seen them with. They claim to be relatives,” he said.

Child identity theft is a newer crime. People use a child’s Social Security Number to apply for credit cards, for example, believing no one will notice for years.

Red flags of possible identity theft include: denial of credit, lost mail, calls from debt collectors, strange bills and incorrect medical history.

“Pay attention to any (mailings) from the IRS and check bank accounts,” Kipfmiller said.

He also recommends not carrying Social Security cards, shredding unneeded documents, monitoring credit score and signing up for fraud alerts.

An audience member asked about data breeches.

“People bring in those letters all the time. Most of the time, nothing happens, but be on the look out. You can put a freeze on your credit report. Contact each of the three places (Experian, TransUnion and Equifax),” Kipfmiller said.

Residents also can get a free credit report from all three credit bureaus once a year.

“I don’t trust the internet,” said a woman in the audience.

Subscribe Now: For all the latest local developments, breaking news and high school sports content.

“I use online banking,” Kipfmiller said. “Online banking is safe. Some are never going to touch it. I’m never going to tell a customer you have to be online. There are pros and cons to both. Online banking is more convenient. You can check to see your accounts every day. With paper, you have to wait a month or call or go into the bank. The risk of online is scams. Someone calls and impersonates the bank. They send you a code. You give them the code, and you’re authorizing them to go into your online banking. That money is hard to get back,” Kipfmiller said. "If you’re not online and have checks and paper statements, your full account number is on that statement. Your check has your name, address, routing number on that."

“If you’re going to be online, you can’t fall for those scams,” he continued. “Online, you’ve just got to be smart with it. Anytime you’re in a situation, stop, pause and think about it.”

The Federal Trade Commission offers free personalized recovery at identitytheft.gov.

— Contact reporter Suzanne Nolan Wisler at swisler@monroenews.com.

This article originally appeared on The Monroe News: Monroe banker shares tips to avoid identity theft and scams